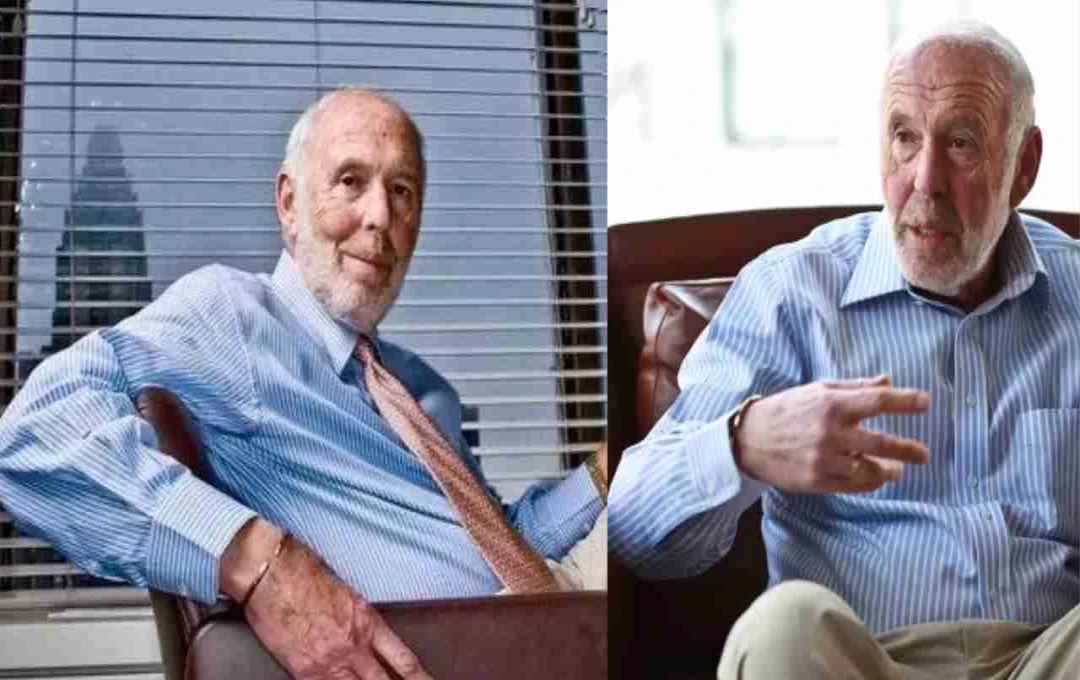

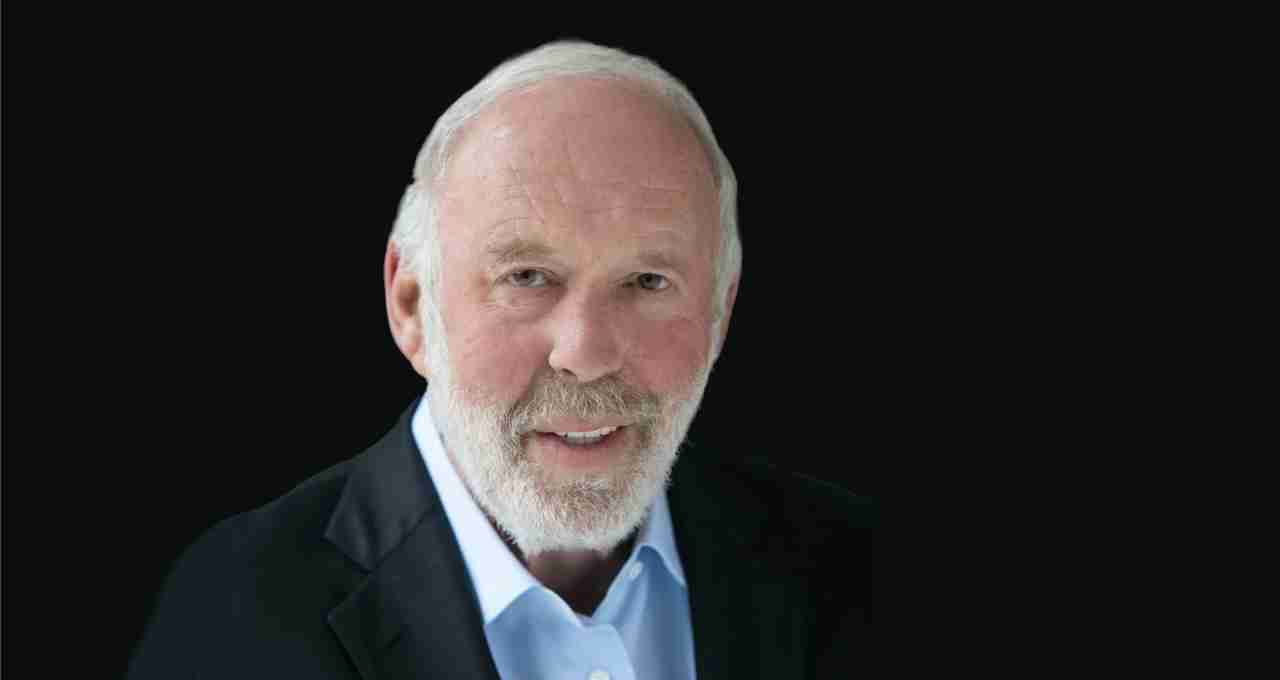

Jim Simons, mathematician and pioneer of quantitative trading, revolutionized the stock market with his company, Renaissance Technologies, achieving unprecedented success through data analysis.

Stock Trading: Stock market trends and investment strategies have undergone significant changes in recent years. Many aspire to make it a career, but the majority of smaller investors incur losses in the trading world. However, some individuals are earning phenomenal profits through their long-term approach and mathematical expertise, one such name being Jim Simons.

Jim Simons' Journey from Traditional Trading to Quantitative Trading

Jim Simons, known as the 'Quant King,' brought a new dimension to the world of stock markets. He believed that trading should be approached with a mathematical and scientific perspective. Using his mathematical knowledge and data analysis, he introduced quantitative trading in America and gradually popularized it worldwide.

Early Life and Education

Born in 1938, Jim Simons displayed an early interest in mathematics. He earned a BS in Mathematics from the Massachusetts Institute of Technology (MIT) and later a PhD from the University of California, Berkeley. His focus was on geometry, and his work was recognized as significant in the field of mathematics even at the age of 23.

Pre-Trading Career

Before venturing into trading, Simons' career revolved around mathematics and academia. He taught mathematics at Harvard and MIT and also worked for the US Department of Defense. Here, he grasped the importance of pattern recognition and data analysis, which later formed the foundation of his trading strategies.

Entering Trading at Age 40

Jim Simons entered the world of trading at the age of 40. Initially, he employed traditional trading methods but quickly realized that emotional decisions hindered success in the market. Subsequently, in 1982, he founded his company, Renaissance Technologies. His aim was to make trading more systematic and organized through mathematics and data.

Renaissance Technologies and the Medallion Fund

Following the establishment of Renaissance Technologies, Simons launched the Medallion Fund in 1988, accessible only to company employees and a select few investors. This fund proved to be Simons' greatest success, generating immense wealth.

Quantitative Trading and the Use of Mathematical Models

Simons' trading strategy was based on quantitative trading, utilizing mathematical models and data analysis. He analyzed historical market data and observed that unusual data sources, such as weather patterns, economic indicators, and trading volume, could also influence market prices.