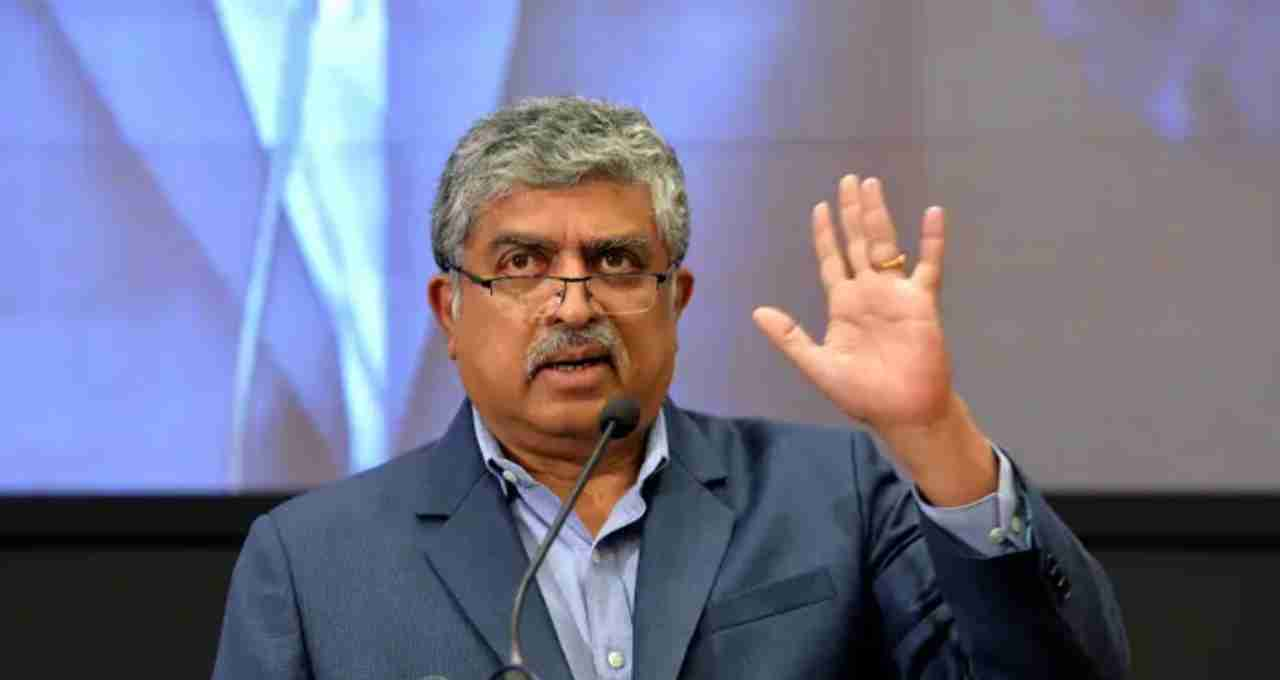

Nandan Nilekani believes the energy sector is poised for a transformative change, mirroring the impact UPI had on the financial sector. Every home could become an energy producer, utilizing solar panels and EV batteries.

Nandan Nilekani: Infosys co-founder and Aadhaar card architect, Nandan Nilekani, anticipates a significant transformation in India's energy sector, similar to the revolution Unified Payments Interface (UPI) brought to the financial landscape. He highlighted the immense importance of this shift for the nation's economy and citizen engagement.

Every Home to Become an Energy Producer and Seller

During an event with entrepreneurs, Nilekani explained that while electricity supply has historically relied on traditional grid systems, the future envisions every home as an energy producer, seller, and consumer. He emphasized the feasibility of household energy generation through solar panels and electric vehicle (EV) batteries, thereby integrating consumers directly into the market.

Preparing for a Shift in Energy Consumption

Nilekani pointed out that while people currently purchase energy in small quantities, like LPG cylinders, electricity has been entirely grid-dependent. The future will empower every home to generate its own energy and sell or utilize it as needed. This represents a revolutionary step for the energy sector.

A UPI-like Revolution Possible in the Energy Sector

Using UPI's success as a model, Nilekani suggested that just as UPI simplified and democratized digital payments in the financial sector, similar advancements through new technologies will reshape the energy sector.

UPI's Success and International Expansion

Over the past decade, UPI has become the backbone of India's digital payment system, accounting for 80 percent of retail transactions. Its simplicity and extensive banking network have made it the preferred payment method for millions of users. Furthermore, UPI has established a global presence.

Global Acceptance of UPI

UPI's success is not limited to India; it is now operational in seven countries. It is currently used in the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius, enabling Indian citizens to conduct international payments.