In today's digital banking landscape, where most people rely on online transactions, knowing the IFSC code has become crucial. This code not only ensures funds are sent to the correct account but also makes transactions faster and more secure. This article explains what an IFSC code is, its format, its importance, and how to find it.

What is an IFSC Code?

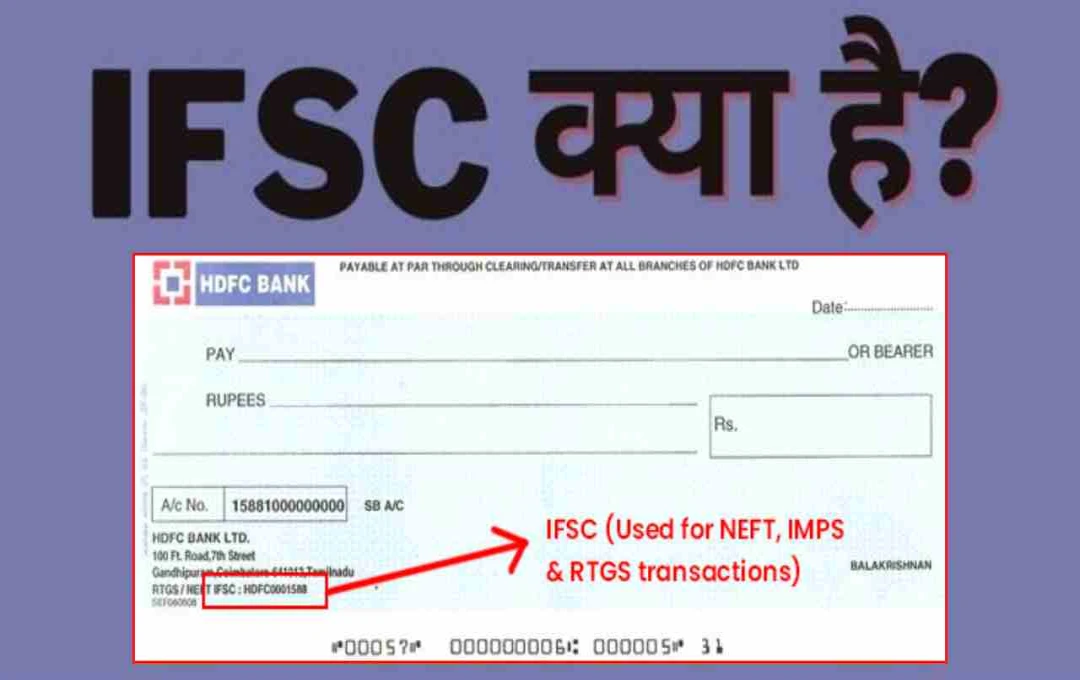

IFSC stands for Indian Financial System Code. It's an 11-character alphanumeric code that uniquely identifies a specific branch of a bank. This code facilitates online fund transfers between two bank accounts using methods like NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service).

IFSC Code Structure

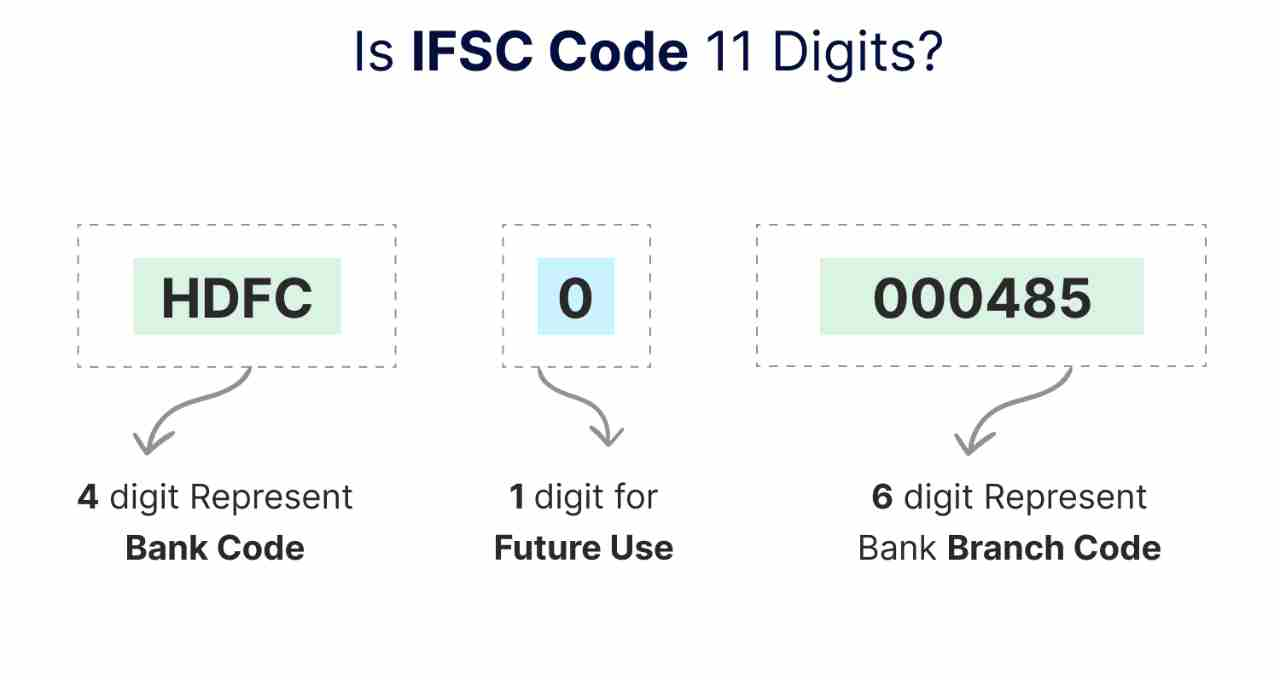

An IFSC code follows this structure:

- First 4 characters: Bank's short code (e.g., PUNB - Punjab National Bank)

- Fifth character: Always '0', reserved for future use.

- Last 6 characters: Unique identification number of the bank branch.

Example

PUNB0055000

PUNB → Bank Name: Punjab National Bank

0 → Reserved digit

055000 → Bank Branch: Mumbai Andheri West

Why is the IFSC Code Important?

- Ensuring correct fund transfer: The IFSC code guarantees that your funds reach the correct bank and branch.

- Faster and secure transactions: It plays a vital role in making online payments secure and swift.

- Transaction identification: The IFSC code is crucial for tracking transactions in case of payment failures or refunds.

How are Fund Transfers Made Using the IFSC Code?

The IFSC code is used for fund transfers through:

- NEFT (National Electronic Funds Transfer): A batch processing system where funds are transferred at predetermined intervals. Used for general transactions.

- RTGS (Real Time Gross Settlement): Used for instant transactions of large amounts (above ₹200,000).

- IMPS (Immediate Payment Service): A 24x7 service for instant money transfers via mobile apps or internet banking.

How to Find a Branch's IFSC Code?

To find a bank branch's IFSC code, you can use these methods:

- Passbook and Checkbook: Most banks print the IFSC code on the passbooks and checkbooks they provide to customers.

- RBI's Official Website: You can find the IFSC code on the Reserve Bank of India's website (https://www.rbi.org.in) by entering the bank and branch name.

- Bank's Website or Mobile App: Almost every bank's website or mobile app lists the IFSC code along with branch details.

- Printed on the Check: The IFSC code is usually printed near the MICR code at the bottom of the check.

- Visit the Bank Branch: If none of the above methods are available, you can visit the respective bank branch.

Important Precautions

- Always verify the IFSC code before making a transaction.

- Entering an incorrect code may result in funds being sent to the wrong account or transaction failure.

- When searching for IFSC codes online, only use trustworthy websites or official bank portals.

In today's rapidly digitizing banking world, knowing the IFSC code is essential for every customer. It simplifies and speeds up transactions while ensuring funds reach the intended recipient. Therefore, never underestimate the role and utility of the IFSC code when making online transactions.