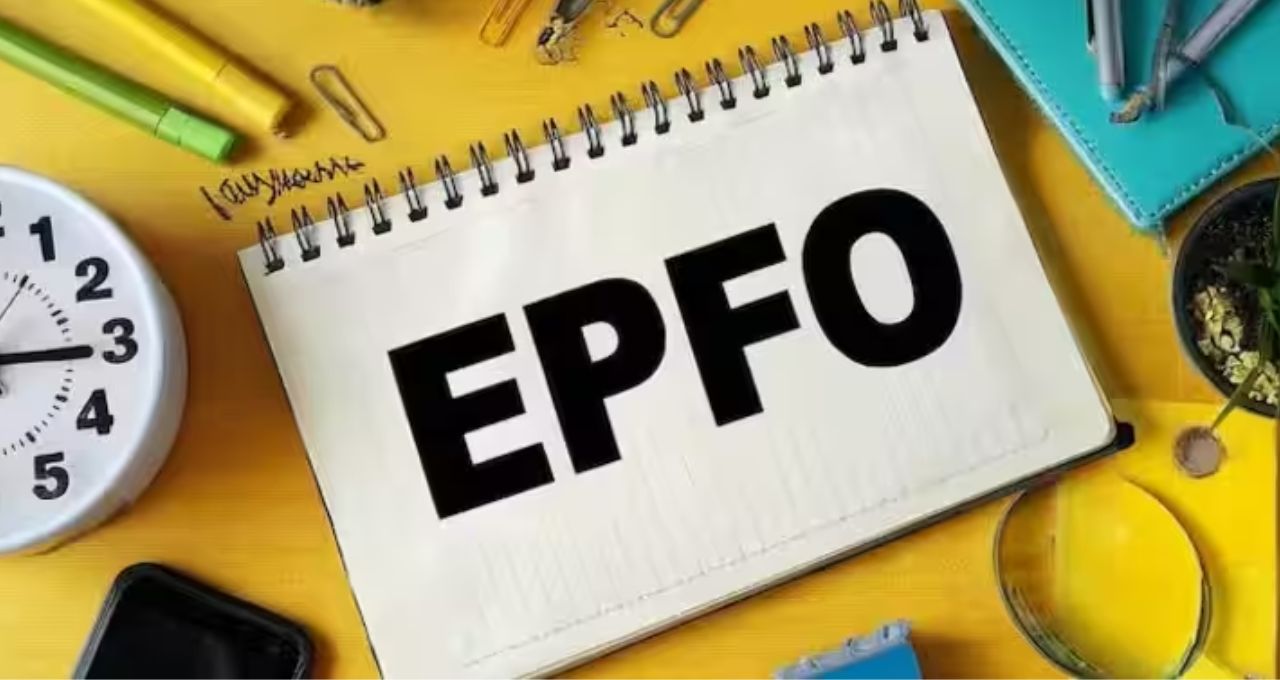

This week could be significant for the 7 crore account holders of the Employees' Provident Fund Organisation (EPFO). The government may announce new EPF interest rates this week, potentially benefiting millions of employees.

Business News: According to sources, a Central Board of Trustees (CBT) meeting is scheduled for February 28, 2025, chaired by Union Minister of Labour and Employment, Mansukh Mandaviya. This meeting will determine the EPF interest rate for the fiscal year 2024-25. Last fiscal year (2023-24), the EPF interest rate was 8.25%, and a similar rate or a slight increase is anticipated this time.

Why the expectation of an interest rate hike?

EPFO has received better returns on its investments this year, making an increase in interest rates seem likely. Interest rates over the past three years have been as follows:

2023-24: 8.25%

2022-23: 8.15%

2021-22: 8.10%

An interest rate of 8.25% or higher this year would be the highest in the last four years.

Will account holders receive a new gift?

Along with interest rates, the meeting may also discuss a new Interest Stabilisation Reserve Fund. The fund aims to provide EPF account holders with stable interest rates, minimizing the impact of market fluctuations. If approved, this proposal could be implemented from 2026-27.

How will EPF account holders benefit?

* Higher interest rates will yield increased returns.

* The Interest Stabilisation Reserve will provide future protection against interest rate declines.

* Retirement funds will be ber for private sector employees.

The EPF scheme is considered one of the safest investment options for private sector employees. Both employees and employers contribute, making it a crucial part of retirement planning. All eyes are now on the February 28th meeting. Will the government offer account holders a significant benefit? The decision will be made this week.