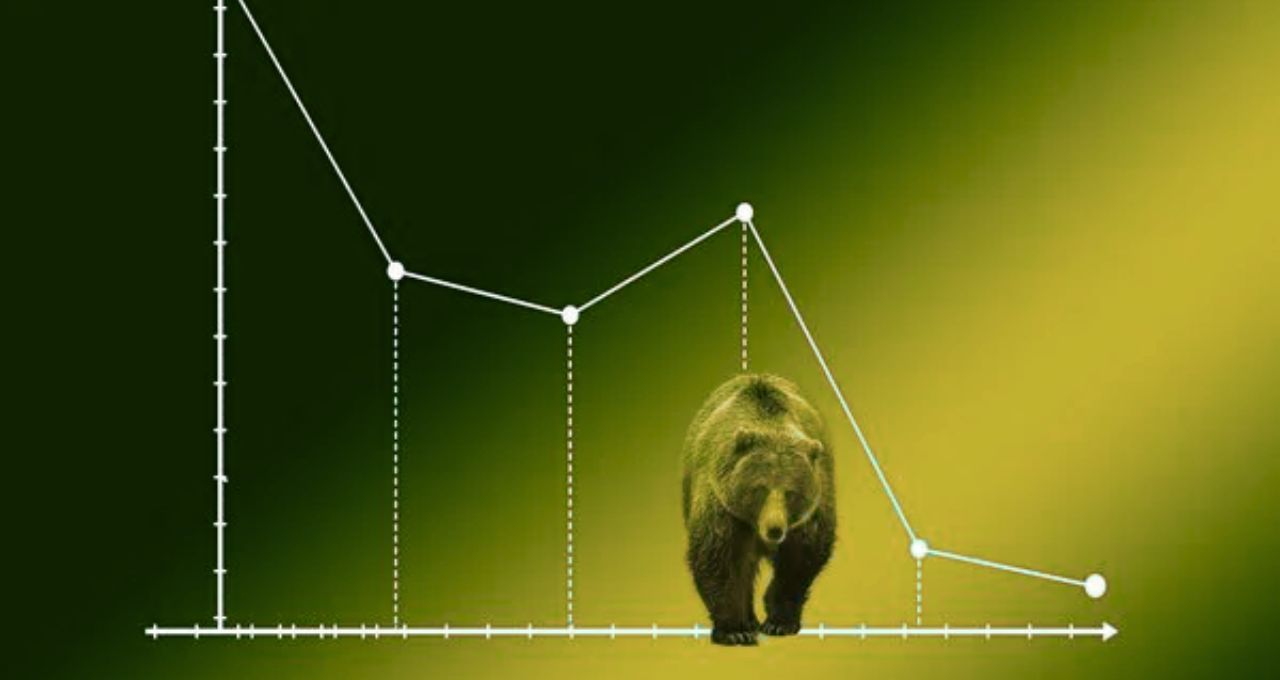

Sensex and Nifty continue their downward trend, trading more than 10% below their all-time highs. Market pressure is attributed to Donald Trump's tariff pronouncements and FII selling.

Stock Market Crash: The decline in domestic stock markets shows no signs of abating. Monday (February 10th) marked the fourth consecutive day of losses. The BSE Sensex plummeted by 671 points, or more than 0.8%, to a low of 77,189, while the Nifty 50 index fell 202 points to close at 23,357.6. Both the Sensex and Nifty are currently trading approximately 10% below their all-time highs.

Which stocks witnessed the steepest declines?

Several prominent stocks experienced significant losses on Monday. Among the Sensex's top losers were Tata Steel, Power Grid, Zomato, NTPC, Reliance Industries (RIL), Bajaj Finance, Titan Company, IndusInd Bank, Tata Motors, HDFC Bank, Axis Bank, and Sun Pharma. These companies saw their share prices decline by 1% to 3.6%.

On the Nifty, JSW Steel, Hindalco, BPCL, ONGC, Coal India, Shriram Finance, Cipla, Dr Reddy's, Adani Enterprises, and Trent were among the top underperformers. However, the broader market also suffered, with the Nifty Midcap index falling 1.5% and the Nifty Smallcap index dropping 1.7%.

Major reasons behind the stock market decline

1. Donald Trump's Tariff War, Decline in Metal Stocks

Statements made by former US President Donald Trump regarding steel tariffs fueled investor concerns. Reports suggest the US may impose a 25% tariff on countries exporting steel and aluminum. This news led to a sharp decline in steel stocks.

During intraday trading, the Nifty Metal index slumped 3%, reaching a low of 8,348. Individual stocks saw significant losses, with Vedanta falling 4.4%, Steel Authority of India (SAIL) dropping 4%, Tata Steel declining 3.27%, and JSW Steel falling 2.9%.

2. Trump's 'Tit-for-Tat' Warning

Trump warned of retaliatory tariffs against countries imposing tariffs on the US. This statement followed China's imposition of 10-15% retaliatory tariffs on US goods, increasing investor uncertainty and putting pressure on the market.

3. Large-Scale Sell-Off

Investors are engaging in widespread selling across most sectoral indices. Only the Nifty FMCG index registered a marginal increase of 0.5%, while other indices experienced declines.

Nifty Metal Index: 3% decline

Nifty Realty Index: 2.47% decline

Nifty Media Index: 2% decline

Nifty Pharma Index: 1.8% decline

Nifty PSU Bank and Financial Services Index: 1% decline

Nifty Bank Index: 0.8% decline

4. Rise in Bond Yields

Yields on 10-year Indian government bonds increased by 2% on Monday, reaching 6.83%. Investors are shifting towards safer investment options like bonds compared to equities.

This rise in bond yields followed the Reserve Bank of India's (RBI) 25 basis points (bps) repo rate cut on February 7th, 2025.

5. FII Selling and the Impact of the Dollar Index

Foreign Institutional Investors (FIIs) continue their selling spree in the Indian stock market. They have offloaded shares worth ₹10,179 crore so far in February. This selling pressure is exacerbated by the rising dollar index and the weakening rupee. On Monday, the Indian rupee hit a record low of 87.92 against the US dollar.