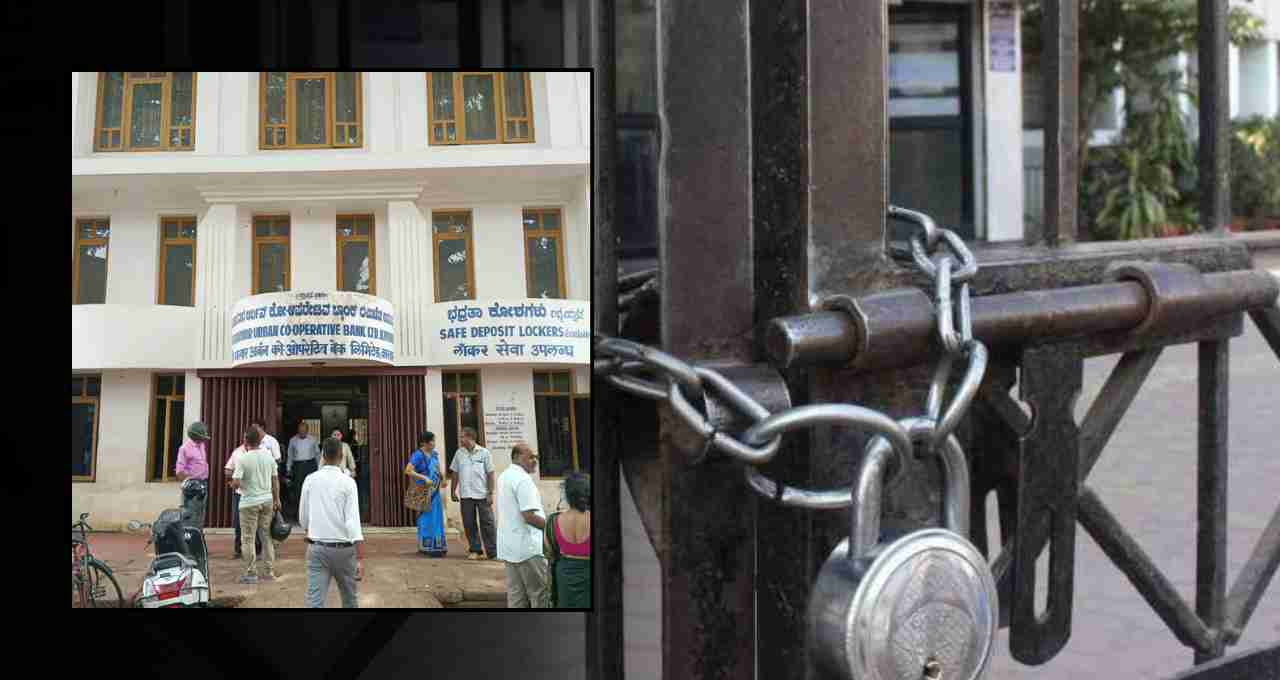

The Reserve Bank of India (RBI) has taken a major step by cancelling the license of Karwar Urban Co-operative Bank, located in Karnataka. The bank will no longer be able to conduct any banking activities from July 23, 2025. The notification issued by the RBI clearly states that the bank did not have sufficient capital and there was no economic viability for its continued operation.

Following the license cancellation, the bank's operations have been completely halted, and the RBI has directed the Karnataka government to initiate the bank's liquidation process. A liquidator will be appointed to sell the bank's assets and complete the process of returning money to customers and creditors.

Why This Decision Was Made

The RBI's investigation revealed that the bank was unable to cover its expenses, nor was there any prospect of it doing so in the future. The bank's financial condition was continuously deteriorating. Losses were mounting, and the bank became unable to return money to its depositors.

In such a situation, the RBI exercised its powers and decided to revoke the bank's license. The bank had neither adequate capital nor a b source of income.

Banking Operations Cease, Customers Worried

Karwar Urban Co-operative Bank will no longer be able to provide any type of banking service. This means that account holders can no longer withdraw or deposit money. The bank's branches have been closed, and all types of activities have been suspended. This has created an atmosphere of concern among thousands of customers, especially those who have kept their life savings in this bank.

₹37.79 Crore Has Been Returned So Far

DICGC (Deposit Insurance and Credit Guarantee Corporation) has so far returned ₹37.79 crore to account holders. This amount has been transferred directly to customers' accounts or given to them via checks. Customers who have not yet received their money should contact DICGC or the bank.

How to Get Your Money Back: Know the Process

Account holders will need to fill out a claim form to get their deposit back. Some necessary documents will be required for this, information about which can be obtained from the bank's website or the official DICGC site.

After contacting the bank or DICGC, customers will have to submit their identity and account-related documents. Only after this will the process of returning their money be initiated.

No Guarantee on Amounts Exceeding ₹5 Lakh

If a customer has more than ₹5 lakh deposited in their account, it is important for them to know that DICGC only guarantees up to ₹5 lakh. The return of amounts above this depends on the sale of the bank's assets and the liquidation process.

This is a lengthy process and can take years. If the bank's assets do not generate sufficient funds, customers with larger deposits may suffer losses.

RBI's Action Alerts Other Banks

This decision by the RBI serves as a warning to other small banks. If a bank's financial condition deteriorates and it is unable to protect its depositors, the RBI may take similar strict measures.

Therefore, small and regional banks need to improve their balance sheets and increase transparency. The security of depositors should be a priority in every situation.

Bank Closed, But Relief from Insurance

Many customers are worried about the closure of Karwar Urban Co-operative Bank, but the relief is that most account holders are expected to get their entire deposit back. The DICGC system has provided depositors with a certain level of security.

However, this incident has also shown that it is very important to check the financial condition and credibility of any bank before depositing money in it. Because once a bank's condition deteriorates, getting the money back is not easy.

Related Documents and Contact Information on DICGC Website

If a customer has not yet received their money, they should contact DICGC or the bank as soon as possible. Information on required documents, the claim form, and detailed process information is available on the DICGC website:

https://www.dicgc.org.in