This fund was launched on February 25, 1993, meaning this scheme has been active in the market for over 32 years.

A scheme from Tata Mutual Fund is currently in the news for providing bumper returns to long-term investors. This open-ended equity scheme, named Tata Large & Mid Cap Fund, has transformed a monthly investment of ₹10,000 through a 25-year SIP into ₹3.81 crore. This scheme was launched on February 25, 1993, and has been in the market for over 32 years.

Significant Returns Over the Long Term

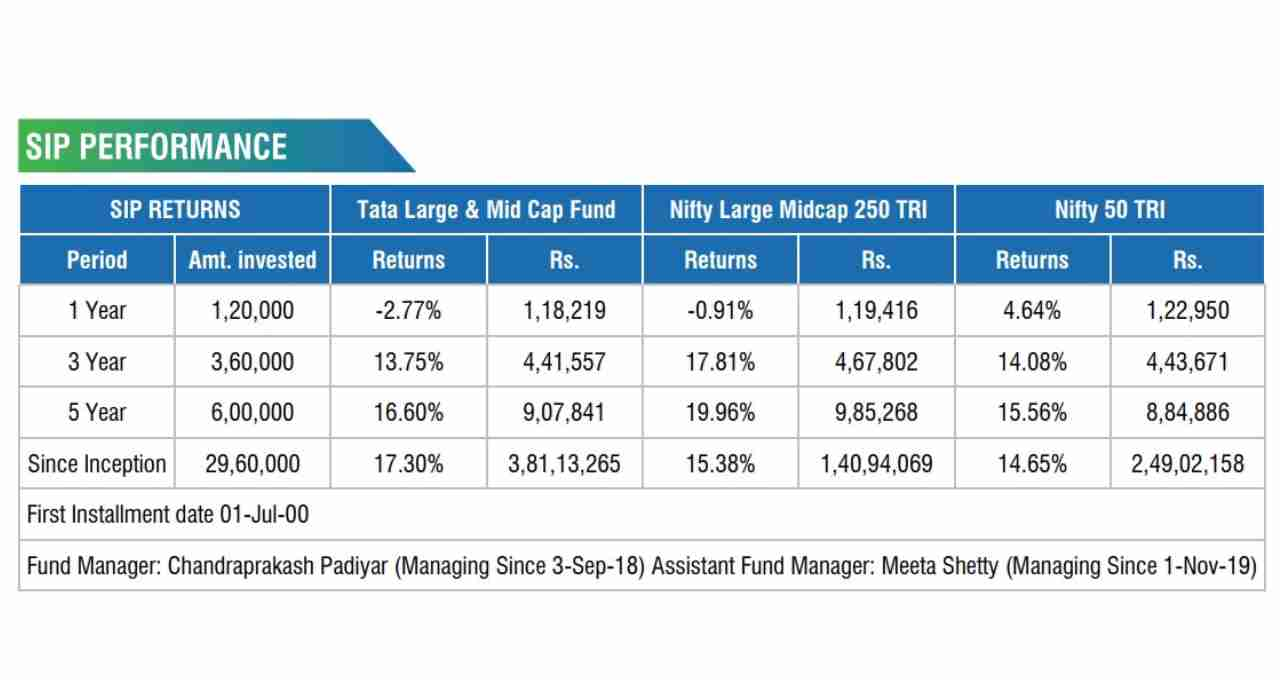

The average annual return (CAGR) from the fund since its launch has been approximately 17.30 percent. Data indicates that if someone had invested ₹10,000 monthly in this fund through SIP, starting July 1, 2000, their investment would be worth over ₹3.81 crore after 25 years. This amount has become an example for investors, especially those who invest with patience and discipline.

Fund Structure and Investment Model

Tata Large & Mid Cap Fund is an equity fund that invests equally in large-cap and mid-cap companies. The fund's strategy involves investing at least 35 percent in large-cap and at least 35 percent in mid-cap companies. The remaining 30 percent is managed under a flexi-cap approach, giving the fund manager the freedom to invest that portion wherever they see fit based on market movements.

Fund Management and Strategy

This scheme is managed by Chandraprakash Padiyar and Meeta Shetty, who are considered experienced fund managers at Tata Asset Management. Their focus is on GARP (Growth at Reasonable Price). This means they select companies that have the potential for good future growth and are attractively valued.

The companies chosen for the fund are characterized by low debt and b free cash flow generation. Such stocks are seen as “compounders” – stocks that provide consistent returns over the long term.

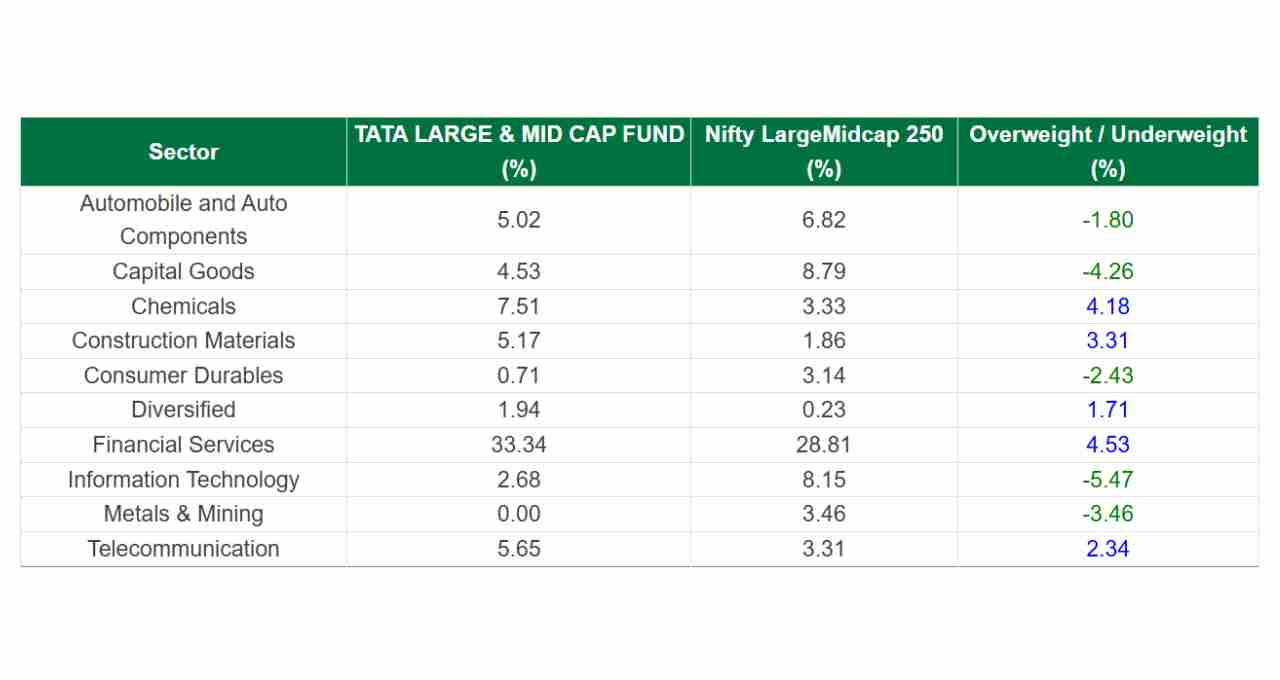

Portfolio Positioning

Currently, the fund's portfolio consists of around 53 stocks. The top 10 stocks have a weightage of approximately 45 percent, indicating that the fund managers have high conviction in these stocks. The portfolio is divided into two parts: one part is composed of stocks from safe and b companies, providing stability and liquidity to the portfolio, while the other part is invested in companies that have the potential to perform unexpectedly well.

Sectors the Fund Avoids

Fund managers avoid sectors that are cyclical and have a high debt burden. The fund, in particular, does not invest in commodity sectors and similar industries because they are highly impacted by external and global factors. This approach results in relatively lower risk for the fund and maintains long-term stability.

Turnover and Strategy

The fund's portfolio turnover is very low, indicating that the managers adopt a buy-and-hold strategy. This means that once a stock is selected, it is not frequently changed. This approach proves to be very beneficial for long-term investments.

Investment Features and Conditions

Investment in this fund can be started with as little as ₹5,000, while SIP can be started with just ₹100. There is no lock-in period for the fund, but if an investor withdraws more than 12 percent of their units within 90 days, an exit load of 1 percent will be charged.

As of May 31, 2025, the expense ratio of this fund was 1.75 percent, which is around the industry average.

Outperforming the Benchmark

The benchmark index for this fund is the NIFTY Large Midcap 250 TRI. Data shows that the fund has not only surpassed its benchmark but has consistently outperformed it. This is why it has generated good profits for investors over the long term.

32 Years of Trust

Tata Mutual Fund is among the oldest mutual fund houses in the country. Launched in 1993, the Tata Large & Mid Cap Fund continues to perform bly today. With such a long track record and a disciplined approach to investment, this fund has carved a special place among investors who expect slow but steady returns through SIPs.

Earnings Shown in Return Chart

Investors who joined this fund in 2000 and have been doing a monthly SIP of ₹10,000, now have a capital of over ₹3.81 crore. This figure not only demonstrates the fund's strength but also shows how mutual funds can create significant wealth in the long term.

This performance of the Tata Large and Mid Cap Fund has certainly become an inspiring example for investors. It shows how disciplined investment, wisely selected stocks, and SIPs over time can make ordinary investors millionaires.