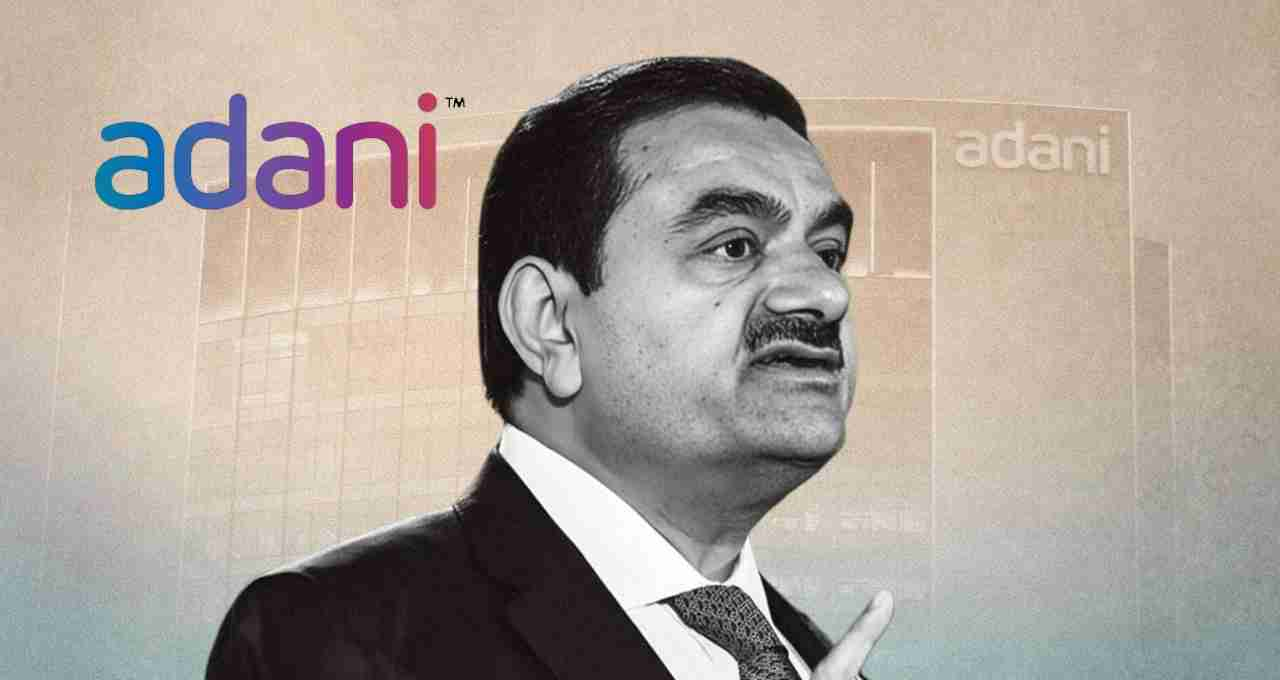

Gautam Adani-led Adani Group is preparing to list its airport unit on the stock market. According to a recent Bloomberg report, the Adani Group plans to bring the Initial Public Offering (IPO) of Adani Airport Holdings Limited (AAHL) by 2027.

Adani Airports IPO: India's leading industrialist Gautam Adani's Adani Group is planning to list its airport unit, Adani Airport Holdings Limited (AAHL), in the public markets by 2027. This move is part of the group's $100 billion capital expenditure (CapEx) plan, aimed at expansion in sectors like energy, infrastructure, and logistics.

Current Operations of Adani Airport Holdings

Adani Airport Holdings currently operates eight major airports in India, including Ahmedabad, Mumbai, Bengaluru, Jaipur, Lucknow, Trivandrum, Mangalore, and Guwahati. Furthermore, the group also plans to construct the Navi Mumbai International Airport, which will become operational in the coming years.

Plan to Raise Capital through IPO

The group plans to raise approximately $1 billion in equity from investors through the IPO. This amount will be used for expanding airport operations, upgrades, and investments in infrastructure projects. Additionally, Adani Airport Holdings recently received a $750 million investment from a consortium of international banks, with $400 million earmarked for refinancing existing debts.

$100 Billion Capital Expenditure Plan

The Adani Group plans to spend $100 billion in capital expenditure over the next five to six years. A significant portion of this amount will be invested in energy transition projects, green energy components, and digital infrastructure. Furthermore, the group has also announced plans to invest over $88 billion in the Rajasthan state, encompassing expansion into sectors such as renewable energy and cement.

reuters.com

Demerger and Independent Operations

Jugeshinder Singh, the Chief Financial Officer of the Adani Group, has confirmed that the airport business will operate independently through a demerger by 2027-28. He stated that the airport business should be financially independent, organizationally capable, and able to continuously invest to ensure its independent operation.

Potential Challenges and Strategic Steps

While the Adani Group's plans are ambitious, the group may face certain challenges. In recent years, the group faced allegations of fraud from Hindenburg Research, which led to a decline in the share prices of the group's companies. Additionally, the US Department of Justice launched an investigation into bribery allegations, although the Adani Group has denied these accusations. Under these circumstances, the group will need to improve transparency and corporate governance to regain investor confidence.