AI technology is now becoming a weapon for cybercriminals. Sam Altman warned that voice cloning and deepfakes threaten the banking system. Financial institutions now need to adopt security systems that are even smarter than AI.

AI Fraud: While Artificial Intelligence (AI) is making life easier on one hand, on the other, it is now becoming a new weapon for cybercriminals. OpenAI CEO Sam Altman recently warned at a Federal Reserve conference that if precautions are not taken now, AI-enabled banking fraud could become a serious crisis in the future.

AI Technology Becomes New Weapon for Cyber Fraudsters

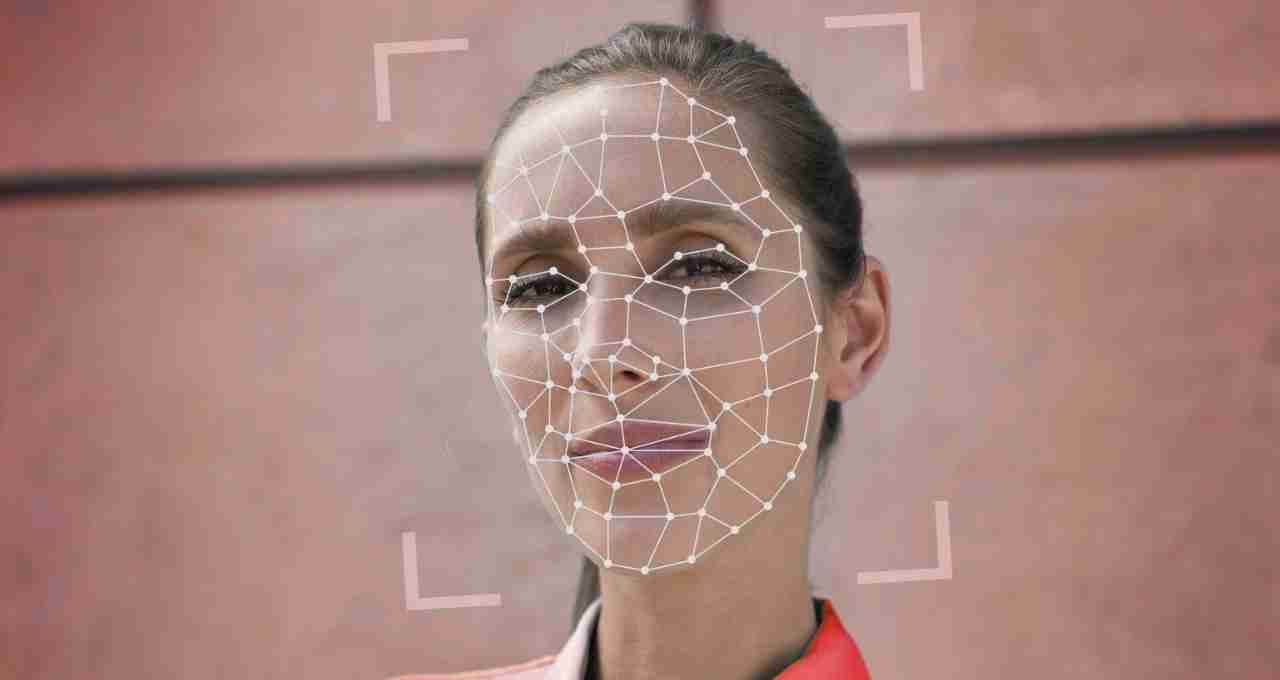

AI has developed very rapidly. Features like voice cloning, deepfake videos, and generative AI are no longer limited to laboratories. Today, these technologies have also reached the hands of common cyber fraudsters. Sam Altman says that AI has now reached such an advanced level that it can perfectly mimic any person's voice. This means that if a bank uses voice authentication, AI can bypass it as well.

Banks are Making a Big Mistake

At a Federal Reserve conference, Sam Altman said that many banks still rely on authentication systems that can prove to be very weak in the face of AI. Voiceprint authentication, which was once considered secure for high-profile customers, is now rapidly becoming obsolete. AI-based voice cloning is now rendering this technology almost ineffective.

What is Voice Cloning and How Does it Work?

Voice cloning is an AI technology in which a person's voice can be copied exactly based on a few seconds of recording. This technology has become so sophisticated today that even a family member, office staff, or even a bank officer mistakes the fake voice for the real one. This allows fraudsters to easily ask for OTPs, extract bank details, or transfer money.

Deepfake Video Will Increase the Risk Further

Altman also warned that in the coming years, video deepfake technology will also reach a dangerous level like voice cloning. Meaning, now not only your voice, but also your face, expressions, and even the movement of your eyes can be shown in fake videos. This could put biometric authentication in the financial system at risk.

What is the Solution?

According to Sam Altman, only those organizations will be safe who make their systems as smart as AI. They need to adopt new age technologies such as:

- Multi-Factor Authentication (MFA)

- Bio-Behavior Analytics

- AI-enabled Security System

- Dynamic Passwords

as soon as possible.

Not Only Banks, Every User is at Risk

AI fraud is not limited to banks only. If you use digital wallets, UPI, Paytm or any other payment app, then you are also within the scope of this threat. Fraudsters can train AI models from your social media profiles, videos, audio, and even recordings of old calls.

What Should a Common User Do?

- Do not overuse your voice and video on social media.

- Do not share personal information on unknown calls or messages.

- Never rely solely on voice-based authentication for banking transactions.

- Change regular passwords and PINs to avoid AI fraud.

- Ask your bank to enable Multi-Factor Authentication.