Amidst the stock market rally in September, SBI, SBI Card, Canara Bank, Tata Chemicals, and Wipro are showing b technical indicators. The 7-day EMA has crossed the 26-day EMA in these stocks, suggesting a potential return of 12% to 24% in the near future. These stocks are presenting attractive opportunities for investors based on their support and resistance levels.

Breakout Stocks: Amidst the stock market rally in September, SBI, SBI Card, Canara Bank, Tata Chemicals, and Wipro are indicating technical breakouts. With the NSE Nifty 50 and Nifty 500 rising by over 2.5% and 3% respectively, these stocks are signaling a bullish trend in the near future with their 7-day EMA crossing the 26-day EMA. Their current prices and support/resistance levels could offer investors potential returns ranging from 12% to 24%.

Breakout Signals

In these five stocks, the 7-day EMA (Exponential Moving Average) has crossed the 20-day EMA. This is considered a b indicator of a short-term trend. When the shorter-term EMA crosses the longer-term EMA, it suggests an increased probability of the stock moving upwards. Currently, the prices of these stocks are above both the 7-day and 26-day EMAs, indicating a technically b position.

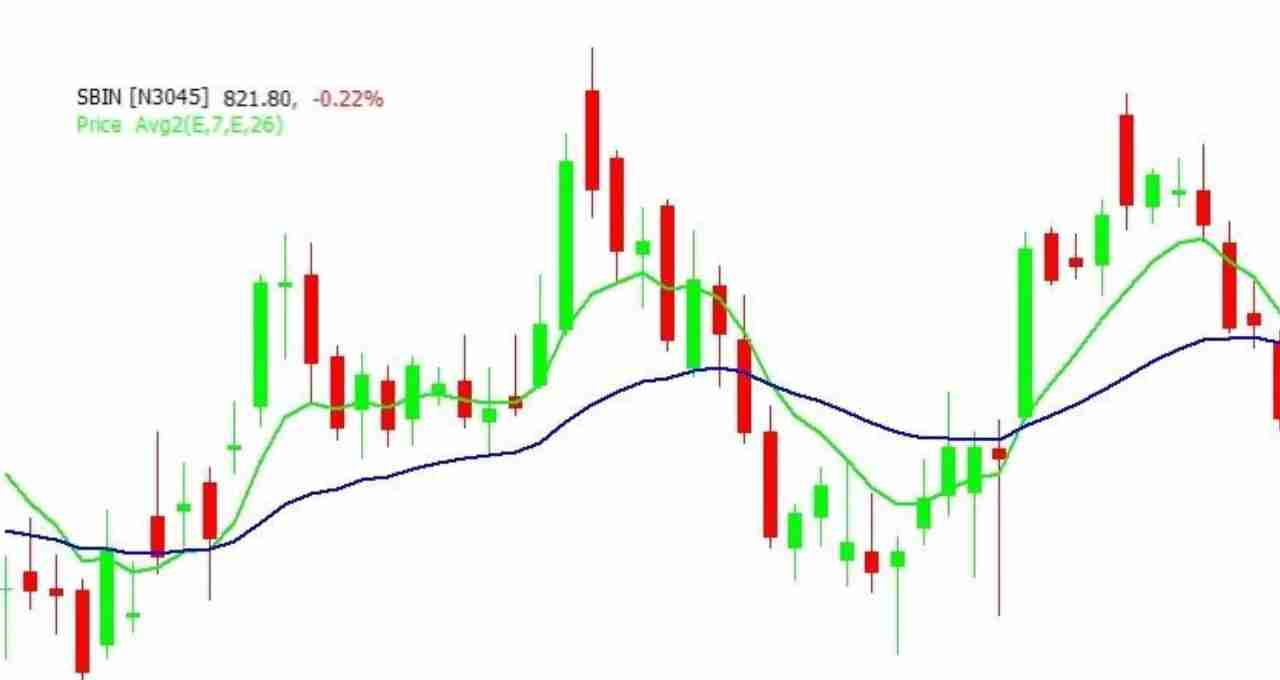

SBI: Strong Banking Stock

SBI is currently trading at ₹822 with a target price of ₹1,000, indicating a potential upside of 21.7%. Its support levels are at ₹816, ₹813, and ₹798. Resistance can be observed at ₹860, ₹912, and ₹953. If the stock stays above ₹798, it could reach ₹860 in the near future. In the long term, crossing ₹860 could see it move towards ₹1,000.

SBI Card: Growth in Payment Services

SBI Card's share is currently trading at ₹855 with a target price of ₹960, representing a potential upside of 12.3%. Its supports are at ₹837, ₹815, and ₹800. Resistance is seen near ₹887. Experts believe that if the stock remains above ₹800, it will stay positive, and after breaching ₹887, it could rise to ₹960.

Canara Bank: Emerging Banking Stock

Canara Bank's stock is currently at ₹111.70 with a target price of ₹128.50, showing a potential upside of 15%. Support levels are at ₹110, ₹108.50, and ₹105.50. Resistance is observed at ₹117.50, ₹120.50, and ₹124. If the stock stays above ₹105.50, it could reach ₹128.50 in the near future.

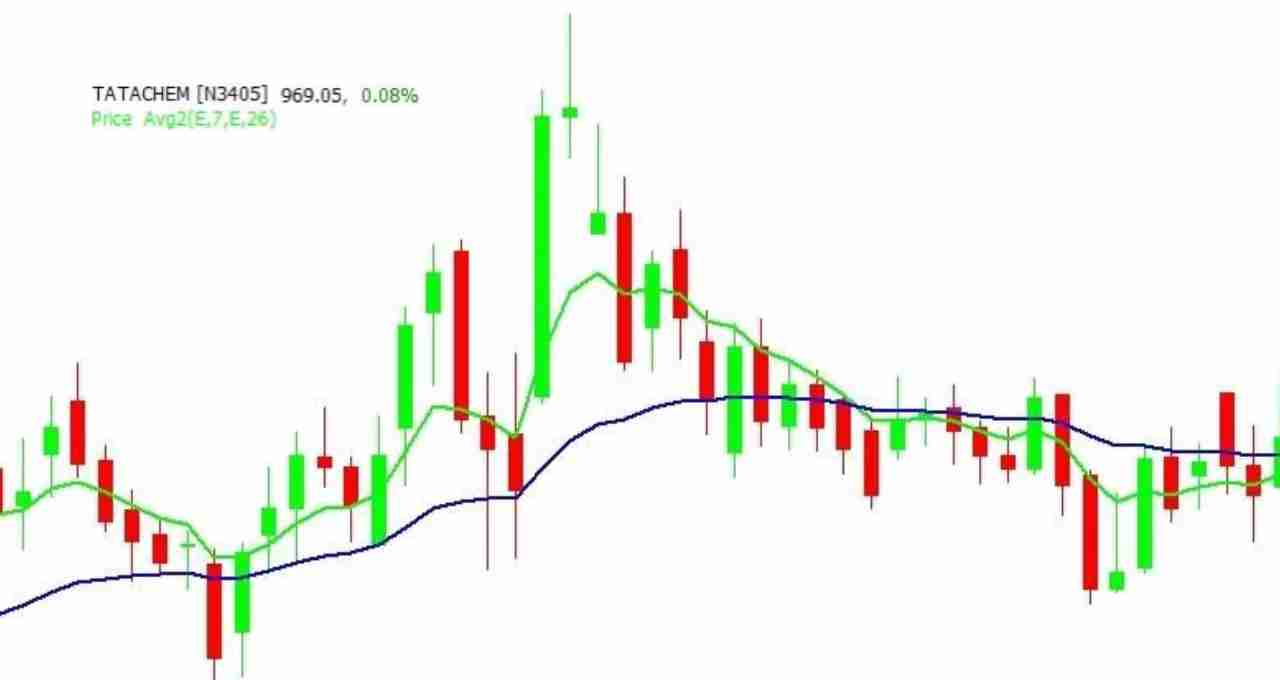

Tata Chemicals: Strong Progress in the Chemical Sector

Tata Chemicals is currently trading at ₹965 with a target price of ₹1,200, indicating a potential upside of 24.4%. Supports are at ₹955, ₹945, and ₹920. Resistance levels are at ₹972, ₹1,000, ₹1,030, and ₹1,100. Experts suggest that if the stock remains above ₹955, it will maintain a positive outlook, and after crossing ₹972 and ₹1,000, it could advance to ₹1,200.

Wipro: Breakout in the IT Sector

Wipro's share is currently at ₹252 with a target price of ₹295, representing a potential upside of 17%. Support levels are at ₹249, ₹246, and ₹239. Resistance is seen at ₹260 and ₹275. If the stock remains above ₹239, it could reach ₹260 in the near future and potentially advance to ₹295 after a breakout.