Technical charts of auto sector giants like Maruti, Mahindra, TVS Motor, Ashok Leyland, and MRF are showing a Golden Cross pattern, which is considered a b signal of an uptrend.

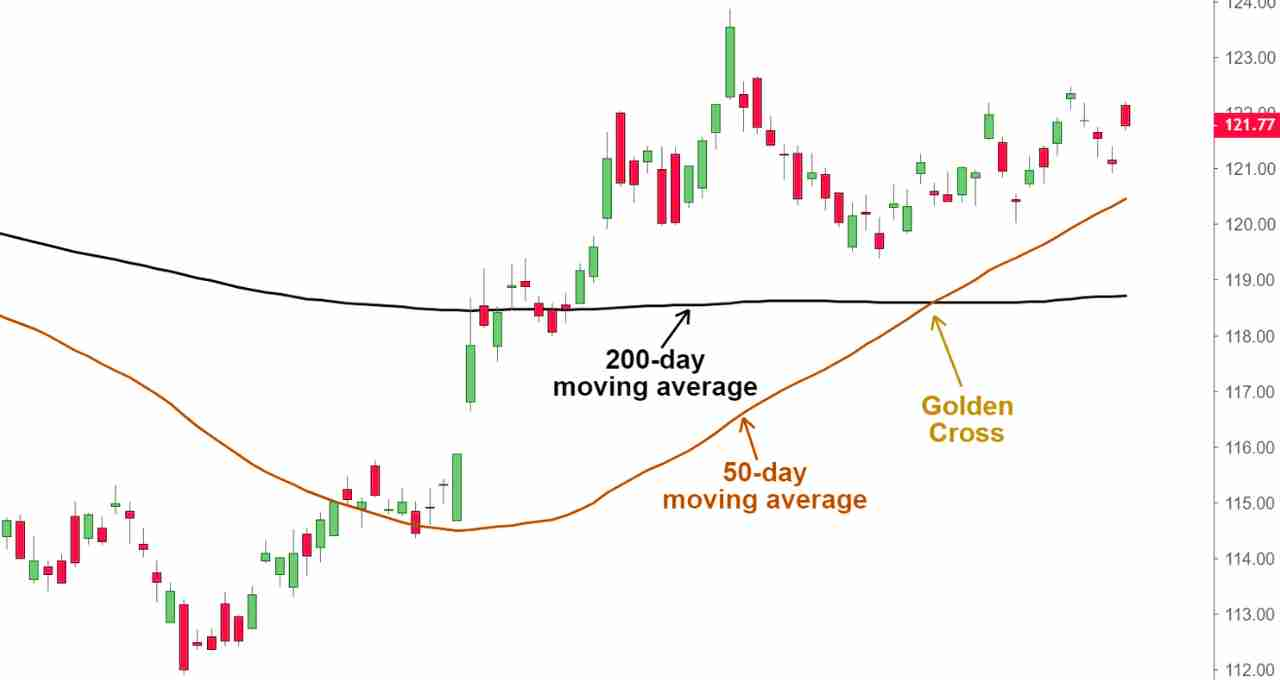

In the stock market, when a specific pattern forms on technical charts, investors' eyes are drawn to it. Nowadays, a similar pattern is visible in the Nifty Auto Index and some of its associated major stocks, which is known as the 'Golden Cross' in the language of technical analysis.

This pattern indicates to investors that a wave of bullishness is about to arrive in the market. This pattern has emerged especially in some prominent stocks of the auto sector, and good growth is expected in these shares in the next few weeks.

What is a Golden Cross?

A Golden Cross occurs when the 50-day moving average (DMA) of a share or index crosses above its 200-day moving average from below. This signifies that the stock or index is expected to see upward momentum.

This pattern has appeared in the Nifty Auto Index after about six months, indicating that the index could move towards the 26000 level. Currently, it is trading at 23909.

Nifty Auto Index: Expectation of Further Momentum

The Nifty Auto Index is currently at the level of 23909, and according to technical analysis, there is a possibility of a rise up to 26000. This shows an upside of approximately 8.8 percent.

The index has b supports at 23319 and 23248, while some resistance can be observed at 24200 and 25200.

Maruti Suzuki: Towards 13500

Maruti's share is currently trading at the level of 12543. There is a possibility of a rise up to 13500. Its 50-DMA is currently at 12455, acting as support.

If the share does not fall below 12200, the upward direction may continue. However, some resistance may occur at 12900 and 13050.

Mahindra & Mahindra: 13 percent growth possible

The Golden Cross formed in M&M shares in the month of June. Currently, it is trading at the level of 3180. Its next potential target is said to be 3600.

The level of 3000 is considered a b support for the share. Resistance may occur at 3270 and 3400 on the upside, but long-term charts are pointing towards bullishness.

TVS Motor: Highest upside expected

A rise of up to 19 percent is estimated in TVS Motor shares. Currently, its price is 2890, and it can reach up to 3450.

According to the charts, the level of 2746 is its b support. If this share goes above 3025, the momentum may accelerate. Temporary resistance may be observed at 3215.

Ashok Leyland: Expected to reach 280

Ashok Leyland's share is at 252, and a target of 280 is visible in it. The trend may weaken if it goes below 238, but as long as this level is maintained, the expectation of growth remains.

According to technical analysts, some obstruction may come at 270, but after crossing it, further surge is possible in the share.

MRF: Record high may be seen again

The formation of the Golden Cross has also been observed in MRF shares. Currently, its rate is ₹1,42,750, and the charts are showing it going up to ₹1,52,000.

The level of 135400 has been considered its b support. Obstruction may occur at 149570 on the upside, but after crossing it, a new record high can be made.