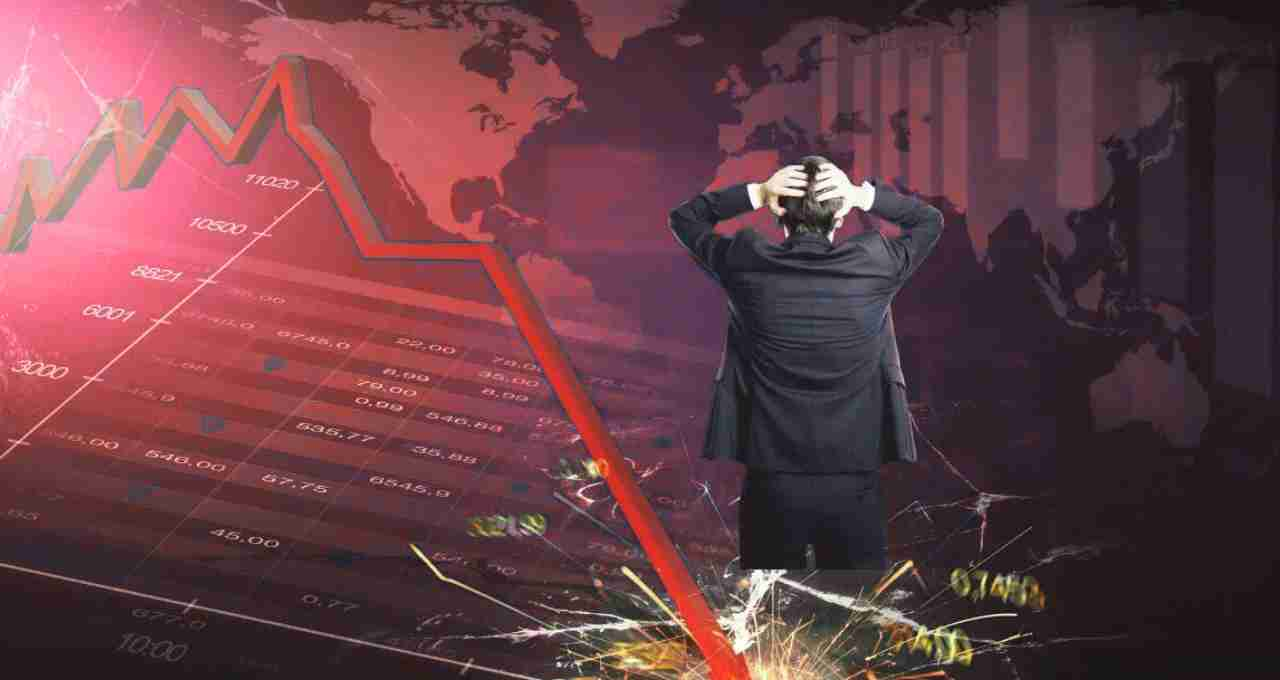

On August 1, 2025, the Indian stock market witnessed a sharp decline. Pharma company stocks faced significant pressure following the US announcement of new tariffs. This directly impacted market momentum, with both the Sensex and Nifty, the major indices, closing lower. Investors faced considerable anxiety after a day of market volatility.

Sensex and Nifty Disappoint

The market opened relatively stable today, but selling intensified in the pharma sector after noon. As a result, the Sensex closed at 80,599.91, down by 0.72 percent or 585.67 points. Similarly, the Nifty closed at 24,565.35, falling by 0.82 percent or 203 points. This marks the second consecutive day the market has closed in the red.

US Tariff Pressure on Pharma Sector

The primary reason for the market decline was the new US tariff policy, which significantly affected the pharma sector. The US government announced increased import duties on certain medicines and healthcare equipment, adversely impacting Indian pharmaceutical companies. Investors began to distance themselves from pharma stocks, leading to a substantial decline in this sector.

More Stocks in Red on NSE

A total of 3,040 stocks were traded on the National Stock Exchange (NSE) today. Of these, only 785 stocks closed in the green, while 2,173 stocks ended the day with losses. The prices of 82 stocks remained unchanged.

Today's Top Gaining Shares

Amidst the market decline, a few select stocks showed strength and performed well. The most prominent among these were Trent, Asian Paints, HUL, Nestle, and Hero MotoCorp.

- Trent Ltd's share closed at ₹5,180, up by ₹162. This was the top gainer of the day.

- Asian Paints' share closed at ₹2,431, with a gain of ₹34.90.

- HUL, or Hindustan Unilever Limited's share, increased by ₹32.50 to reach ₹2,553.70.

- Nestle India's share closed at ₹2,276.50, up by ₹28.80.

- Hero MotoCorp's share also rose by ₹50.90 to ₹4,311.60.

The gains in these companies indicated that consumer goods and the auto sector are currently providing some relief to investors.

Today's Top Losing Shares

On the other hand, some major stocks in the pharma and metal sectors experienced significant declines. The biggest losers included Sun Pharma, Dr. Reddy's, Cipla, Adani Enterprises, and Tata Steel.

- Sun Pharma's share fell by ₹77 to close at ₹1,629.70.

- Dr. Reddy's Labs' share dropped by ₹49.70 to ₹1,220.60.

- Cipla's share declined by ₹51.80 and closed at ₹1,502.80.

- Adani Enterprises' share fell by ₹79.80 to close at ₹2,350.90.

- Tata Steel's share also fell by ₹4.93 to ₹153.01.

These declines created an atmosphere of concern in the metal stocks as well as in the pharma sector.

Other Factors Affecting Market Sentiment

In addition to the tariff news, there is also tension in global markets. The uncertainty surrounding trade between the US and China is also affecting Asian markets. Furthermore, the strengthening dollar and fluctuations in crude oil prices have slightly weakened investor confidence.

Pressure on Midcap and Smallcap Stocks

Besides the large-cap stocks, the midcap and smallcap indices also experienced pressure. Investors appeared to be avoiding risk and moving towards safer stocks. Selling was heavy in small and medium-sized stocks, causing these indices to also decline.

Sector-wise Performance Overview

Only a few sectors managed to stay in the green during today's trading session. FMCG, auto, and consumer durables showed some strength, but the pharma, healthcare, metal, and real estate sectors dragged the market down.

- The pharma index declined by more than 3 percent.

- The metal index fell by about 1.5 percent.

- The FMCG sector appeared to stabilize somewhat, but the gains were very limited.

Foreign Investors' Stance

The stance of FIIs, or Foreign Institutional Investors, also appears to be cautious now. They are balancing their portfolios in light of global events. Today's market selling also indicated activity from foreign investors.