An atmosphere of concern prevails among small business owners in Karnataka these days. The reason: a series of GST notices being sent to traders who have conducted business via UPI in recent years. So far, approximately 6000 traders have received these notices. These are business owners who sell vegetables, groceries, milk, or other retail items, and mostly use digital transactions, i.e., UPI, instead of cash.

Vegetable Vendor Receives Tax Notice of ₹29 Lakhs

The most talked-about case is that of a vegetable vendor in Bengaluru who has been slapped with a GST notice of ₹29 lakhs. According to reports, this vendor had a total transaction volume of ₹1.63 crore over the past four years, entirely through UPI. The Income Tax Department has considered this as business turnover and demanded tax on it.

Stir Among Traders After Receiving Notices

This hasn't happened to just one shopkeeper. According to trade organizations, thousands of small business owners have received similar notices. These notices are generally being sent to traders whose digital transactions have exceeded ₹40 lakhs in the last few years. In such a situation, the GST department says that these transactions fall under the category of business, and therefore, tax assessment is necessary.

GST Officer Says – Tax is Not Final, Relief Possible with a Response

Meera Suresh Pandit, Joint Commissioner of the Commercial Tax Department of Karnataka, has stated that these notices are being sent only as pre-assessment. It cannot be considered a final tax demand yet. Traders can file a response with their documents if they wish. If it is clear that the transaction does not fall within the scope of business or is below the income limit, the notice can be cancelled.

Traders Expressed Displeasure, Warned of Strike

On the other hand, there is significant resentment among traders regarding these notices. Several trade associations in Karnataka have jointly warned of a state-wide strike on July 25. They say that small business owners have been directly served with hefty notices without any warning or investigation, creating an atmosphere of fear and confusion among traders.

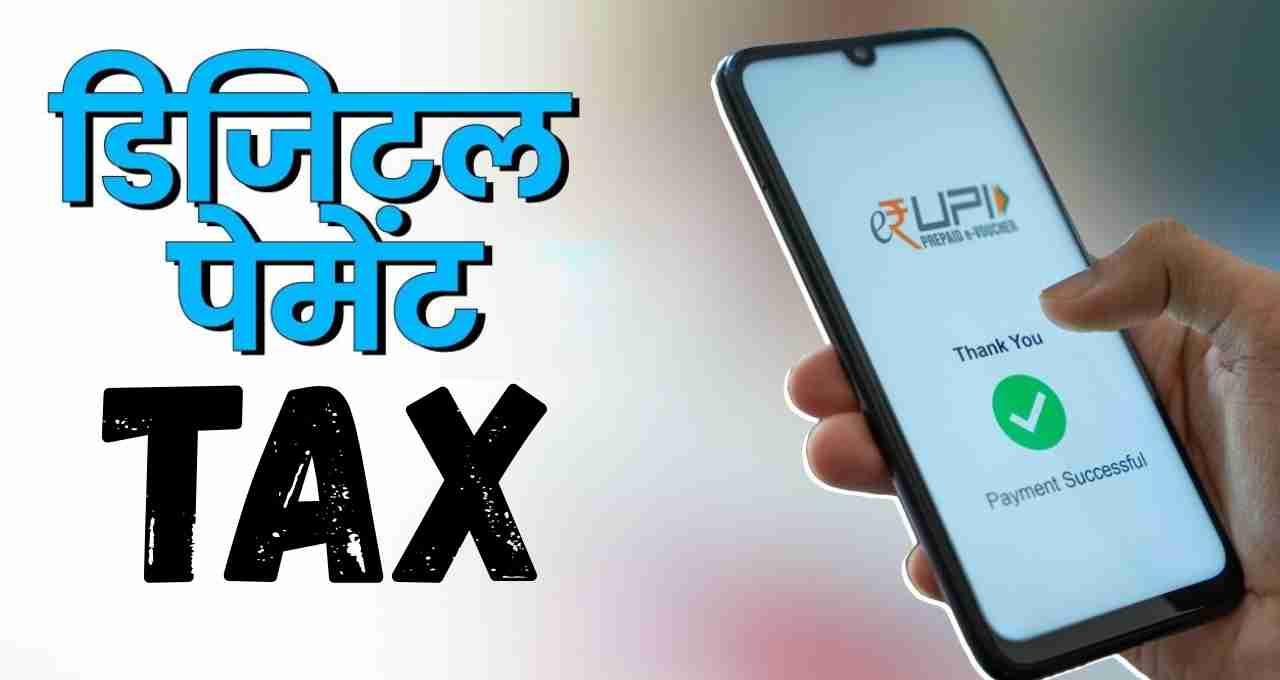

Some organizations have also appealed to stop transactions through UPI. Traders believe that if digital transactions are monitored for tax in this way, small traders will have to return to cash, which could affect the dream of Digital India.

Government's Stance – Necessary Action Within the Purview of the Law

Meera Suresh Pandit clarified that under the GST Act, if the turnover of a business exceeds ₹20 lakhs in the case of services and ₹40 lakhs in the case of goods, registration is mandatory. Along with this, they are also required to file returns and pay taxes from time to time.

She also said that the purpose of the notices is not to scare anyone, but to determine the correct tax. If a trader does not fall under the purview of tax under the rules, there is no need to be afraid.

Data from Digital Payments Becomes Basis for Tax

In fact, the basis of these notices is the data from the digital payment system. Tax authorities now have information on transactions made through UPI and other online payment modes. Using this as a basis, notices are being sent. Officials say that if a large amount of money is continuously being transferred into a trader's account, it is assumed to be part of regular business activity.

A Confusing Situation for Small Business Owners

Many small traders are confused about whether every UPI payment will be considered a business transaction. There are also many shopkeepers who use the same UPI number for their shop as well as for household chores. In such a situation, the total transaction amount appears to be much higher than the actual turnover.

Now it remains to be seen how the government and the tax department balance this situation so that honest small business owners are not unduly burdened, and the tax system remains transparent.