The Reserve Bank of India has granted PhonePe approval to operate as an online payment aggregator. The company will now be able to provide small and large merchants with the facility to accept payments through multiple payment options and ensure instant settlement. This decision will strengthen PhonePe's merchant network and payment gateway services, further increasing its dominance in the digital payment sector.

Online payment aggregator: The Reserve Bank of India (RBI) has granted permission to fintech company PhonePe to operate as an online payment aggregator. This approval was received last Friday, enabling the company to now offer shopkeepers and businesses the convenience of easily accepting and settling payments through various options, including cards, UPI, and net banking. According to PhonePe, this move will bring significant benefits, especially for small and medium enterprises (SMEs), and further strengthen the company's presence in the digital payment ecosystem.

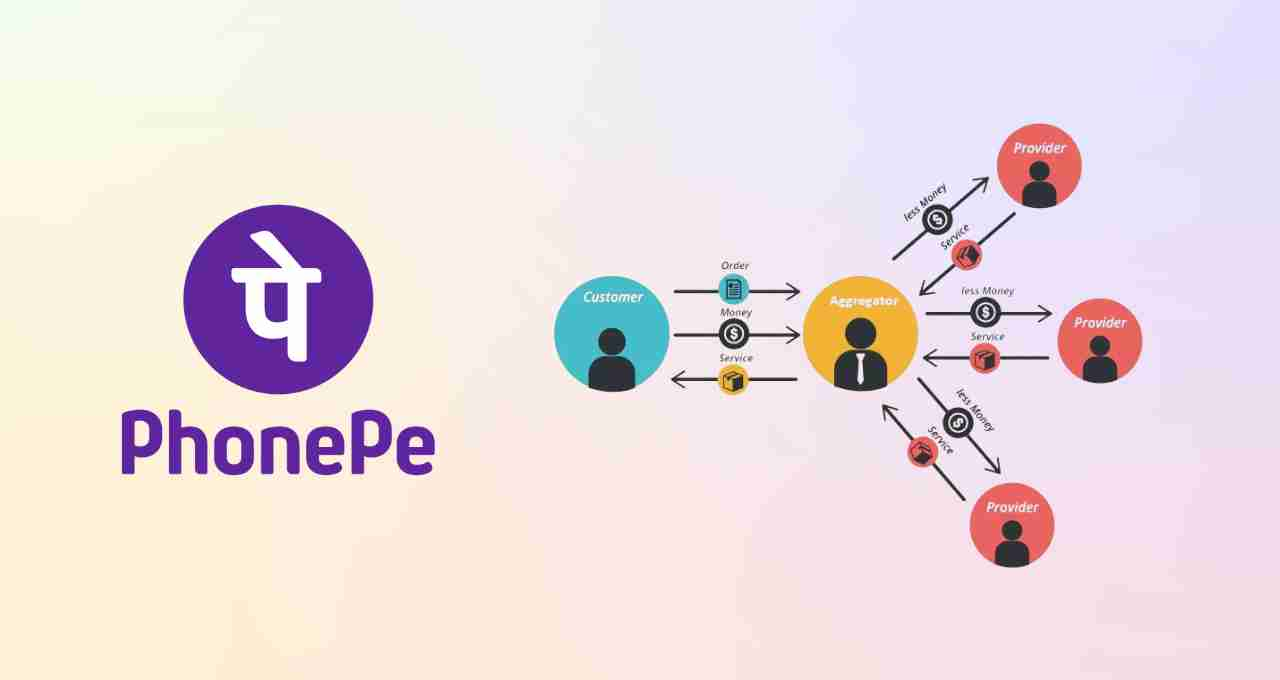

What is an online payment aggregator?

An online payment aggregator is a service that helps small and large businesses accept online payments from their customers. When a merchant partners with a payment aggregator, the aggregator company verifies all their necessary information and documents. Following this, the merchant is onboarded onto the aggregator's platform. Subsequently, the merchant can easily accept payments from their customers via credit cards, debit cards, UPI, net banking, and wallets.

PhonePe gains new recognition

Following the approval granted by the RBI on Friday, PhonePe's scope has expanded significantly. The company will no longer be limited to digital transactions but will also introduce new facilities for small and medium-sized businesses, specifically the SME sector. Yuvraj Singh Shekhawat, CEO of PhonePe Merchant Business, stated that this move would enable the company to reach merchants who have not yet benefited from better services.

Merchants will get easy facilities

PhonePe's payment gateway will offer merchants the convenience of instant onboarding. This means any merchant can start payment facilities for their business in a very short time. Furthermore, this gateway will provide easy integration for developers and a smooth checkout experience for customers. This will also increase payment success rates and make the transaction process more reliable.

How the aggregator model will work

When a customer makes a payment to a merchant via PhonePe, the aggregator will process the funds. This involves coordination with banks, card networks, and other financial institutions. Upon successful payment, the customer will receive instant confirmation. If, for any reason, the payment fails, the customer will also be informed of the reason. This process will not only provide reliable service to merchants but also enhance the customer experience.

PhonePe's journey and strength

PhonePe was launched in 2016. In just a few years, the company became one of India's largest fintech companies. Today, PhonePe boasts over 650 million registered users. The company's merchant network also extends to more than 45 million merchants. PhonePe handles over 360 million transactions daily.

The company's portfolio is also quite extensive. It includes payment services along with lending, insurance distribution, wealth products, the hyperlocal e-commerce platform 'Pincode', and services like the Indus Appstore. Now, with the approval as an online payment aggregator, PhonePe's business model will become even more diversified.

Special for small and medium businesses

With this RBI approval, PhonePe's focus will further shift towards small and medium-sized businesses. Until now, many small merchants were deprived of payment gateway services or had to face complex procedures. This move by PhonePe will help bridge this gap. Especially in rural and semi-urban areas, merchants will now be able to easily adopt digital payments.

The government has consistently emphasized the Digital India Mission. Granting aggregator approval to companies like PhonePe is a significant step in this direction. This will deepen the reach of cashless transactions across the country. Especially during festive seasons, when the number of transactions multiplies, this new avatar of PhonePe will prove beneficial for both customers and merchants.