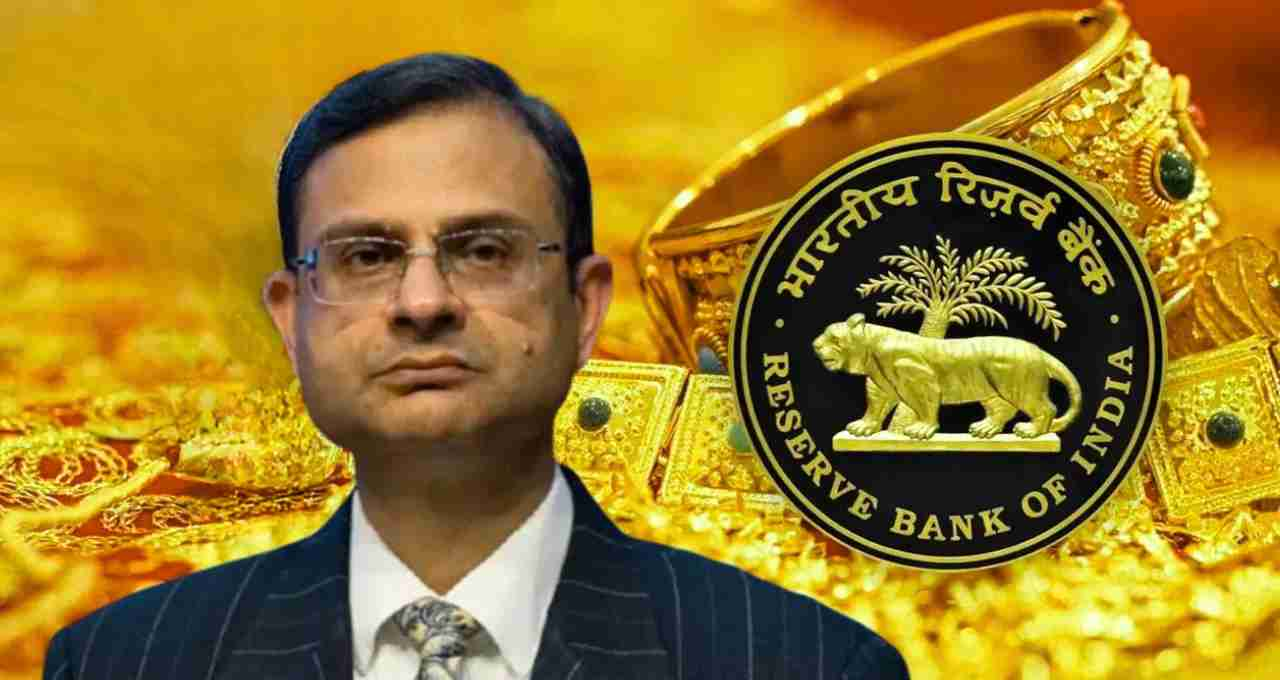

The Reserve Bank of India (RBI) has made a significant decision to further simplify the loan process. Under the new regulations, banks, especially those serving farmers and micro, small, and medium enterprises (MSMEs), will no longer be able to refuse to accept gold and silver as collateral. The central bank has issued a circular in this regard, directing all banks that if a borrower voluntarily offers gold or silver as collateral, the bank is obligated to accept it.

Collateral-Free Loan Rules Will No Longer Be an Obstacle

The RBI has also clarified that this will not affect the existing system of providing loans to farmers and MSMEs without collateral. This new system will apply when a borrower willingly pledges gold or silver. The RBI states that this step does not violate the policy of collateral-free loans but rather provides borrowers with better options.

Which Banks Will This New Rule Apply To?

The scope of the RBI's new directive has also been clarified. This rule will apply to all scheduled commercial banks, regional rural banks, small finance banks, state cooperative banks, and district central cooperative banks in the country. Although the guidelines for collateral-free loans do not already apply to regional rural and cooperative banks, there will be no restriction if they wish to accept proposals involving gold and silver.

Data Duplication and Incorrect Reporting Remain a Major Challenge

The article does not contain the above content. Instead, it discusses the implementation of a unified system for borrower identification and other changes.

The RBI plans to connect all financial institutions to a common system, creating a unique identification for each borrower, allowing them to be recognized throughout the system with the same name and identity. This will not only speed up banking processes but also increase the transparency of loans.

With the help of this unique borrower identification, clear data on the customer's loan history, repayment habits, and creditworthiness will be available to every bank, making credit decisions more accurate and secure.

Beneficial Changes for the Banking Sector as Well

This rule can also reduce the risk of loan recovery for banks to some extent. Assets like gold and silver are considered secure collateral for banks because they have value stability and can be immediately liquidated in the market. This will provide banks with a guarantee without needing excessive documentation or legal processes.

Support for the Rural Economy

Through this initiative, the RBI aims to strengthen the country's rural economy. Small farmers and those associated with cottage industries, who often could not get loans without guarantees, will now be able to use their traditional assets, i.e., gold and silver, to avail banking benefits.

Compliance with the New System is Mandatory

The RBI has also stated that this rule is not merely a suggestion but is mandatory for all relevant banks to implement. Regulatory action may be taken against any bank that does not comply with these instructions.