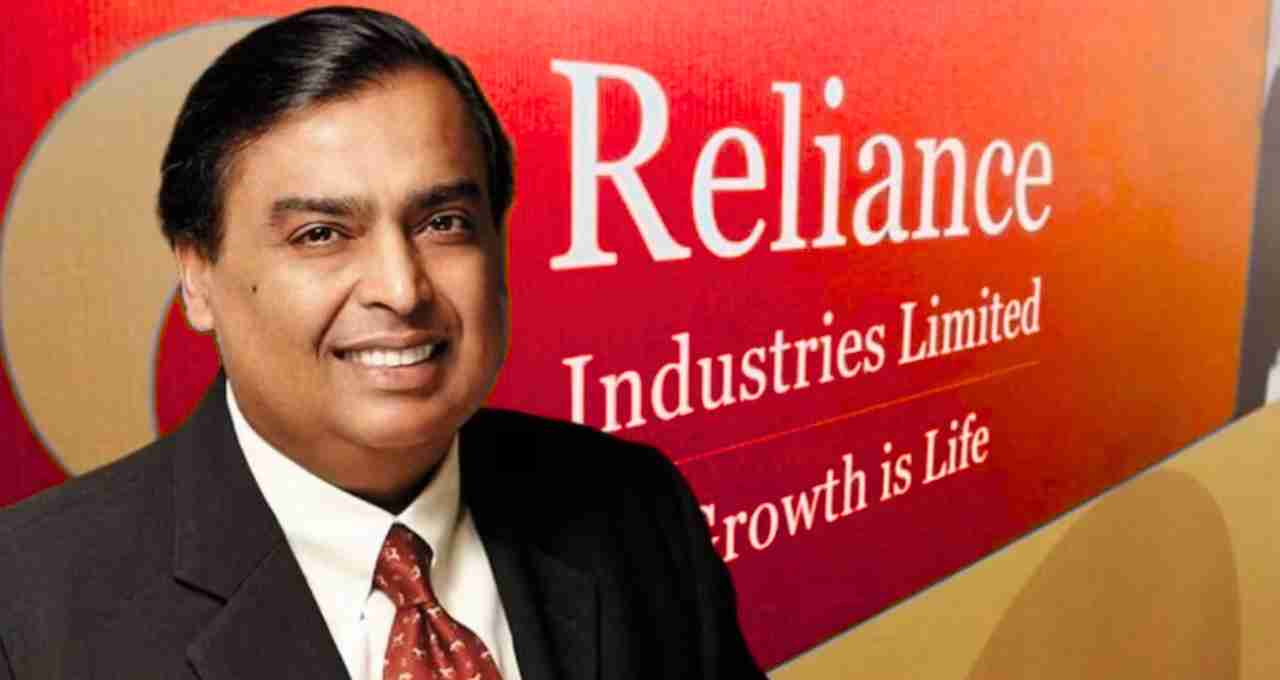

Reliance Industries, the country's largest private company, has announced its 48th Annual General Meeting (AGM). The company's meeting will be held on August 29, 2025, starting at 2:00 PM. Several important issues related to the company will be discussed during this meeting, and major decisions may be taken.

Record Date for Dividend Also Fixed

Along with setting the date for the AGM, Reliance Industries has also shared important information regarding the dividend. The company has announced that the record date for receiving the final dividend for the financial year 2024-25 is fixed as August 14, 2025. The company's board had recommended a dividend of ₹5.50 per share in the meeting held in April 2025, which was announced along with the results of the March quarter. The dividend will be paid within a week after the AGM.

Company's Recent Quarterly Performance

Reliance Industries recently released its June quarter (Q1FY26) results, in which the company's performance was quite b. In the first quarter of the current financial year, Reliance's consolidated net profit jumped by 78 percent to ₹26994 crore, compared to ₹15138 crore in the same quarter last year.

A major reason for this increase is said to be a one-time gain of ₹8924 crore from the sale of stake in Asian Paints. This profit was much higher than the expectations of market experts. Analysts had estimated Reliance's net profit to be ₹22069 crore, while the company performed even better.

Strong Earnings from Operations

Reliance's total operation income increased by 5.3 percent to ₹248660 crore. The company's operating profit, i.e., EBITDA, jumped by 36 percent to ₹58024 crore. The EBITDA margin was 21.2 percent, which is 4.6 percent higher compared to last year.

The company's total income has increased by 6 percent to ₹273252 crore. This increase has been contributed by various businesses such as oil and gas, retail, and digital services.

Strong Growth of Jio Platforms

Reliance Industries' digital unit, Jio Platforms, has also delivered a b performance. Jio's revenue has reached new heights with a growth of 18.8 percent. The main reason for this is the continuous increase in demand for mobile services and home broadband. The number of Jio's customers is continuously increasing. Along with this, the consumption of digital services has also increased, which has had a positive impact on the company's earnings.

Reliance's Performance in the Stock Market

Even though the Indian stock market saw a decline on the first trading day of August, Reliance Industries' shares showed strength. By noon, Reliance's stock on the BSE was trading at ₹1400.70 with a gain of about ₹11.

Despite the ongoing tensions in global markets, the company's shares have shown a positive trend, which reflects the confidence of investors. Investors are showing enthusiasm due to the announcement of the AGM date and news related to the dividend.

Major Announcements Expected at the AGM

Like every year, there is excitement in the market regarding Reliance's Annual General Meeting this time as well. This meeting is not limited to dividends or quarterly results, but also reveals the company's major future plans, new projects, technology investments, and business expansion.

In previous years, several important announcements such as 5G services, green energy projects, retail expansion, Jio Phone, and digital plans have been made at Reliance's AGM. In such a situation, this year's meeting is also considered special.

Continued Focus on the Digital Front

Reliance Industries has been focusing especially on its digital and technology business for the past few years. After establishing a b hold in the telecom sector through Jio, the company is now adopting an aggressive strategy in areas such as broadband, cloud, and digital payments. The AGM may also shed light on new investments or partnerships related to this sector.

Retail Business Becomes a Strong Pillar

Reliance Retail has now become a major source of income for the company. Reliance Retail's presence is continuously increasing from small towns to metro cities. The company's share has increased rapidly in segments such as food items, clothing, electronics, pharmacy, and online grocery. The expansion plan of this business unit may also be presented at the AGM.