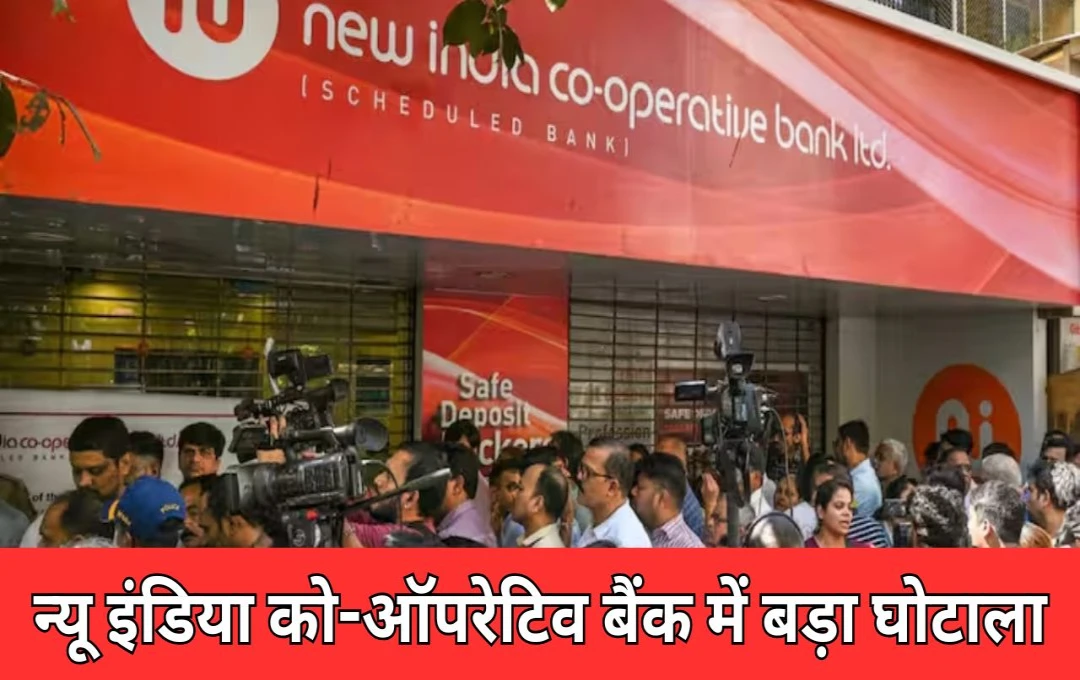

A case of financial fraud has been registered at Dadar Police Station in Mumbai based on a complaint filed by the bank's Chief Accounts Officer. The complaint alleges that the fraud occurred between 2020 and 2025.

Bank Scam: Hitesh Pravinchand Mehta, the former General Manager of New India Co-operative Bank Limited in Mumbai, has been accused of embezzling ₹122 crore. This alleged fraud took place while Mehta was serving as the General Manager and was responsible for the Dadar and Goregaon branches. He is accused of misappropriating the funds from the accounts of these two branches by abusing his position.

Following the discovery of this financial irregularity, the bank administration filed a complaint with the Dadar Police Station, leading to the registration of a case and the commencement of an investigation.

Former General Manager Mehta Accused of Embezzlement of Crores

Dadar police have registered a case based on a complaint filed by the Chief Accounts Officer of New India Co-operative Bank Limited regarding the ₹122 crore fraud. According to the complaint, the fraud was perpetrated between 2020 and 2025. Police suspect that another individual may have been involved in the fraudulent activity besides Hitesh Pravinchand Mehta.

Given the seriousness of the matter, the case has been transferred to the Economic Offences Wing (EOW) for further investigation. Dadar police have filed an FIR under sections 316(5) and 61(2) of the Indian Penal Code (IPC). The EOW investigation will determine how the fraud was committed, the number of individuals involved, and whether there were any lapses in the bank's rules and security protocols.

Reserve Bank of India Imposes Strict Restrictions

The Reserve Bank of India (RBI) has imposed strict restrictions on New India Co-operative Bank Limited. As a result, the bank is prohibited from issuing new loans, renewing existing loans, accepting new deposits, making new investments, making payments on its liabilities, and selling assets.

In a statement released on Thursday, the RBI stated that these stringent measures were taken in light of recent financial irregularities at the bank and to protect the interests of depositors. These restrictions will be effective from February 13, 2025, and will remain in place for the next six months.