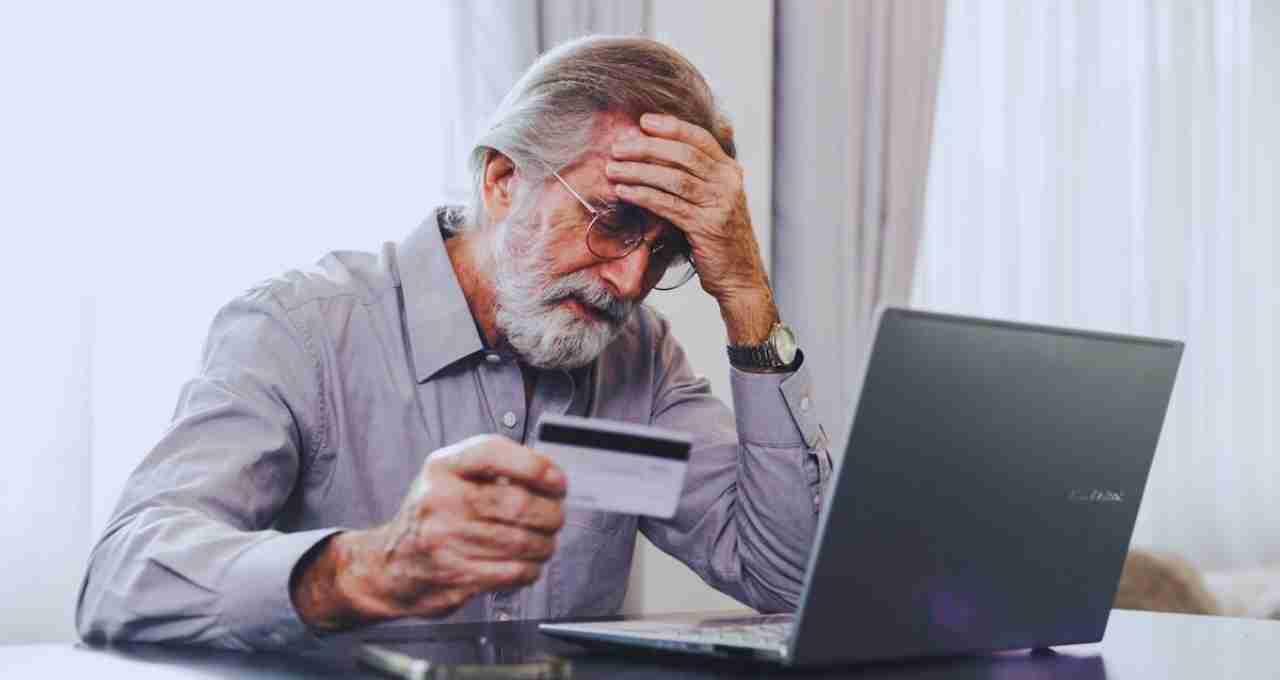

Every year on May 15th, National Senior Fraud Awareness Day is observed. The aim of this day is to educate and protect our senior citizens from financial, digital, and cyber fraud. In today's digital age, with online payments, banking, and social media becoming commonplace, seniors are increasingly vulnerable to scams.

Importance of National Senior Fraud Awareness Day

National Senior Fraud Awareness Day is significant because it aims to educate seniors about fraud and scams. It helps them understand how fraudsters can exploit digital platforms to deceive them. This day provides an opportunity to ensure that seniors are fully informed about their rights, safety precautions, and digital threats.

This day also raises awareness among families and society to promote the safety of seniors, enabling them to take necessary steps to protect their elderly relatives from fraud. Furthermore, it reminds us to spend time with our seniors, understand their experiences and concerns, and safeguard them from any kind of fraudulent activity.

Why is it crucial to protect senior citizens from fraud?

Protecting senior citizens from fraud is paramount today. A major reason is that seniors often have limited income, relying on pensions, savings, or support from their children. If a fraudster steals their hard-earned money, they may not have another chance to earn it back. This not only causes financial loss but also increases the risk of mental stress and depression.

Seniors are often targeted by fraudsters because of their trusting nature and unfamiliarity with technology. Fraudsters employ various methods to trap them, such as:

Fake Bank Calls: Fraudsters impersonate bank employees to obtain confidential information like OTPs, account numbers, or ATM PINs.

Lottery/Prize Scams: False messages like "You've won a lottery of 2.5 million rupees" are sent to extort money under the guise of processing fees or taxes.

Medical and Insurance Fraud: Scams promising cheap medicines or insurance policies are used to swindle money.

Social Media Scams: Fraudsters impersonate relatives or acquaintances to solicit help.

What are some major fraud tactics?

Online and phone scams are constantly evolving, particularly targeting seniors and those less tech-savvy. These scams, while seemingly simple, can be extremely dangerous. Let's understand some major fraud tactics that are crucial to recognize and avoid:

Fake Call Center Fraud: Fraudsters pose as bank officials, claiming account issues and requesting OTPs, card numbers, or personal details. Once this information is provided, bank balances can be emptied within minutes.

Sending Phishing Links: Fake links are sent via email, SMS, or WhatsApp. Clicking these links can introduce viruses or compromise personal information.

Fake Medical or Health Plans: Fraudsters lure victims with promises of cheap medicines, miracle cures, or inexpensive health insurance, only to deliver neither.

Scams related to Government Benefits or Pension Schemes: Fraudsters claim eligibility for pensions or government schemes, requesting Aadhaar numbers, PAN cards, or OTPs to access bank accounts.

Family Emergency Scams: Calls are made impersonating a relative, claiming things such as, "'Your brother is in the hospital" or "Your son is in jail," prompting panicked individuals to send money.

How to observe National Senior Fraud Awareness Day

To observe National Senior Fraud Awareness Day, we should educate seniors about fraud prevention methods. This day reminds us that seniors are a vital part of society, and we must help protect them from scams. We can take specific steps to mark this day:

Stay Connected: Meet with seniors to inform them about fraud. Advise them never to click on unknown calls, messages, or links; if they do, to immediately ignore it and contact a trusted person.

Workshops and Seminars: Organize workshops and seminars through community centers, schools, and social organizations. These events can educate seniors about fraud methods, cybercrime, and preventive measures.

Social Media Awareness Campaigns: Share posts, videos, and information about fraud prevention on social media. This can effectively alert seniors.

Information from Local Police and Helplines: Inform seniors about the cybercrime helpline number (1930) and local police. Teach them to seek immediate help if they become victims of fraud.

How to educate seniors?

The most important step in protecting seniors from scams is providing accurate information. Clearly explain that no bank, insurance company, or government agency ever asks for confidential information like OTPs, ATM PINs, or passwords over the phone. If an unknown caller impersonates a bank official and requests such information, it is undoubtedly a fraudulent attempt. In such cases, hang up immediately and inform a trusted family member.

The family's role is crucial

Protecting seniors is our family's responsibility. To help them, we need to provide them with technological knowledge to avoid digital fraud. We should inform them about the clever tactics fraudsters use and assist them when using mobile phones or the internet.

If seniors live alone, review their banking and digital transactions weekly. This ensures their safety. Also, reassure them that they can contact you without fear if they have any doubts. This provides them with peace of mind and a sense of security.

National Senior Fraud Awareness Day is an opportunity to educate our seniors about digital and financial security. In this increasingly online world, we must keep our parents, grandparents, and other senior citizens updated.