Pricol Targets ₹80,000 Crore Revenue by FY30 and Aims to Become No. 1 in the Global Two-Wheeler Display Market. Emkay Maintains a 'BUY' Rating on the Stock with a Target Price of ₹575.

Pricol, a leading auto components manufacturer, has set ambitious goals for the future. The company aims to achieve a revenue of ₹80,000 crore by fiscal year 2030. In light of this, brokerage house Emkay has maintained a 'BUY' rating on the company's stock, setting a target price of ₹575, which is approximately 29 percent higher than the current price of ₹445.

Emkay's report highlights that the company's plan to jump from an estimated ₹27,000 crore revenue in FY25 to ₹80,000 crore is a significant leap. The company intends to maintain an operating margin (EBITDAM) of 12 to 13 percent in its core business, while targeting a 10 percent margin in the P3L business. Furthermore, the company is also focusing on maintaining a return on capital employed of over 20 percent.

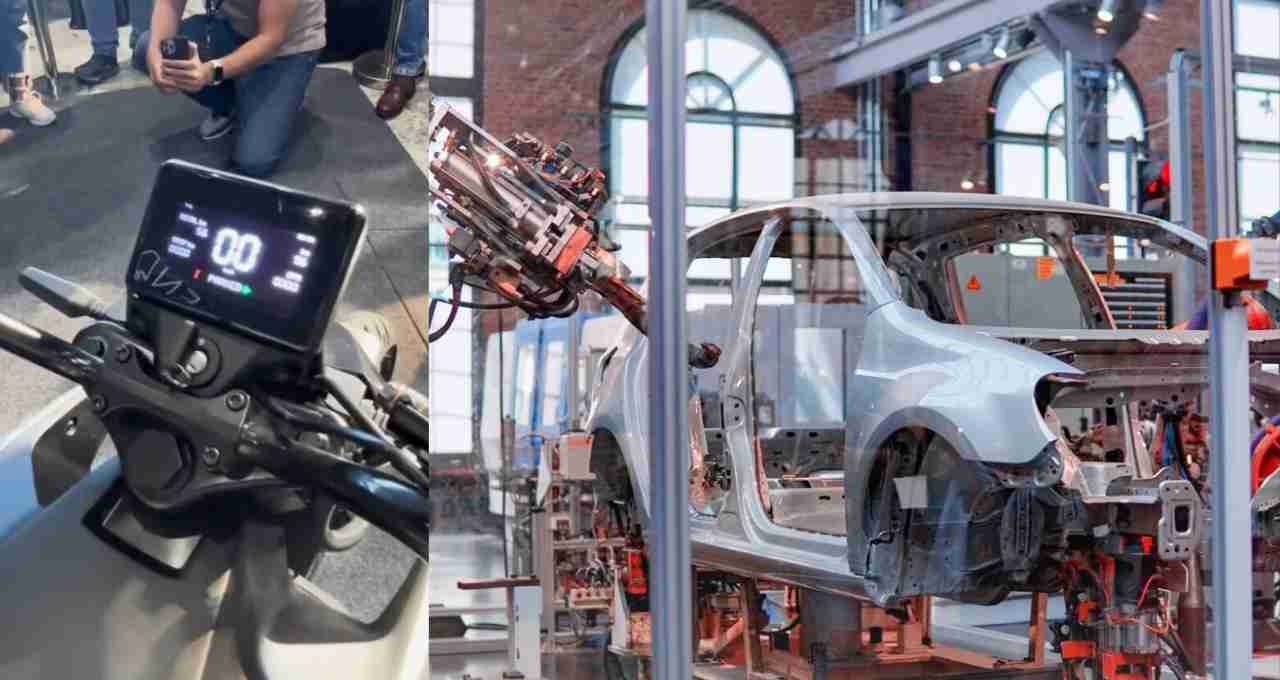

Preparing to Become Number 1 in Two-Wheeler Display Systems

Pricol's primary focus is on two-wheeler digital instrument systems (DIS). Currently, the company holds a market share of 37 percent in this segment, placing it in second position. However, Pricol aims to increase this share to 45 to 50 percent by FY30 and achieve the number one position globally in this segment.

The company also claims to have established b partnerships with Japanese companies like Honda and Suzuki, which could increase the value of content per vehicle to ₹5,000 by FY30. This could significantly boost the company's revenue.

New Opportunities in Disc Brakes and ABS Systems

Pricol has invested significantly in disc brake technology over the past three years. The company has now started receiving orders in this area. In addition, the company is working on braking systems such as CBS and ABS. The demand for these braking systems is increasing in the auto industry, and Pricol is expected to achieve new success in this segment.

In the P3L division, the company aims to double the revenue of this segment in the next three years. To achieve this goal, the company is also considering acquisitions and other inorganic growth options. Currently, the margin for this segment is 7 percent, which is planned to be increased to 10 percent by FY30.

Focus on the Domestic Market for Handlebar Assemblies

Pricol plans to capture a 30 percent share of the domestic market for two-wheeler handlebar assemblies by FY30. To achieve this goal, the company is focusing on technical partnerships, licensing, and in-house technology development. The company believes that technical innovation and partnerships will enable it to gain a b foothold in this segment.

Potential Impact of Rare Earth Magnet Crisis on Production

Emkay's report also indicates that the auto industry may face a major challenge in the coming months. There is a potential crisis in the supply of rare earth magnets between July and August, which could affect vehicle production. The report suggests that this could lead to a production cut of 30 to 50 percent. In June, the cut was between 5 to 10 percent.

Some of Pricol's units may also be affected by this crisis, which could hinder its revenue growth. However, Emkay believes that the company's b order book and long-term strategy can mitigate this risk.

Strategy to Maintain Focus

Pricol's focus is primarily on expanding its core business, investing in technology, and entering new markets. The company is constantly working to improve its product line and add more value. Expenditure on research and development has also been increased for this purpose.

In addition, the company plans to add new customers and establish long-term agreements with existing customers. This will not only ensure stability in revenue but also strengthen its market position in the long run.

Investor Confidence Seen in the Stock Market

Pricol's shares have shown a good increase in recent months. Investors' confidence in the company has increased due to the company's future strategy and positive reports from brokerage houses. The 'BUY' recommendation given by reputed brokerages like Emkay is expected to further boost the stock.