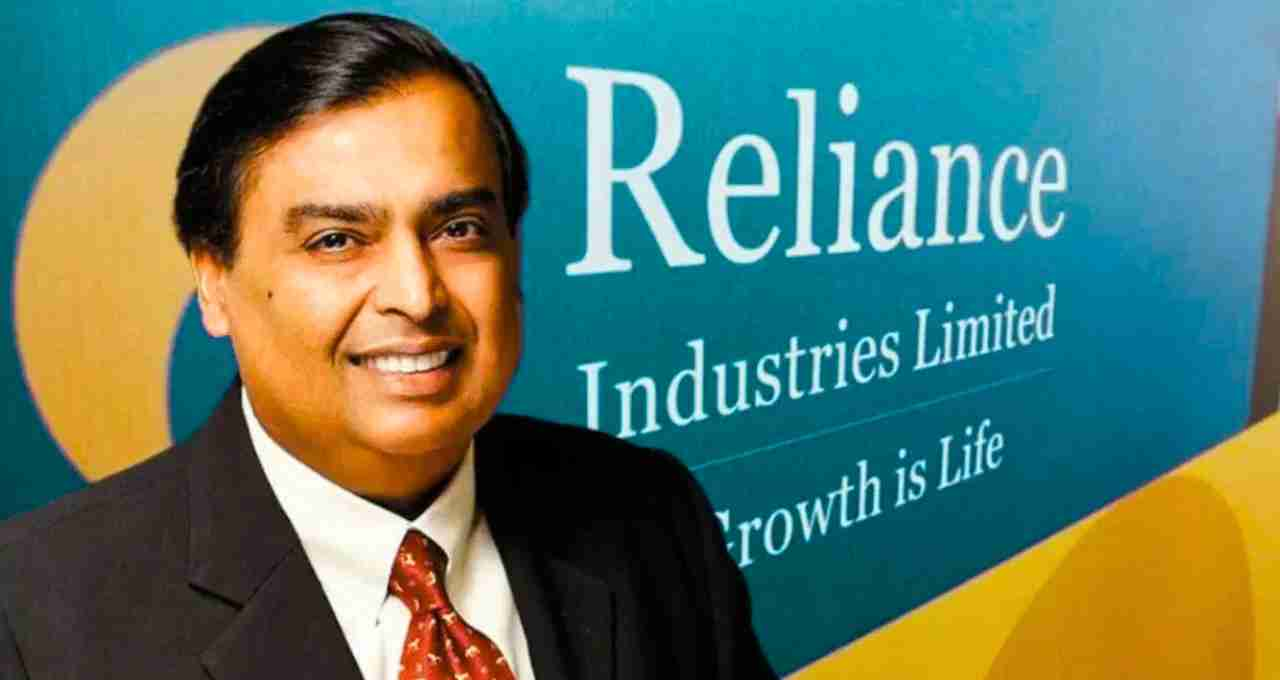

Reliance Industries shares witnessed a sudden drop of 2.7 percent on Monday. On the BSE, the shares slipped to ₹1,436.85, despite the company reporting its highest-ever profit on Friday. Investors were taken aback by this decline, as the company showcased a net profit of ₹30,783 crore, the highest figure ever recorded in any quarter.

Earnings from Asian Paints Boosted Profit

During this quarter, the company received ₹8,924 crore from the sale of its stake in Asian Paints. Furthermore, relief in interest expenses and tax payments further strengthened the net profit. However, the market was not as convinced, as the company's main business segments—Retail and O2C—performed below expectations.

Brokerage Reports Expressed Displeasure

According to Jefferies' report, the company's consolidated EBITDA was 3 percent lower than their expectations. Specifically, the O2C business saw a decrease of 5 percent and Retail saw a decrease of 4 percent. Brokerage firms like Motilal Oswal and MK Global also expressed similar concerns. MK reported that EBITDA was 5 percent and profit was 7 percent below estimates.

Retail Business Disappointed

Reliance Retail has been considered a growth driver, but this time the results have worried analysts. According to Motilal Oswal, the operational EBITDA was 7 percent lower than their expectations. Meanwhile, JP Morgan reported that retail growth stalled at 11 percent, while they were expecting 16 percent. They said that electronics sales slowed due to the onset of the monsoon and the pace of new store expansion also remained sluggish.

Weakness in Oil-to-Chemical Business as Well

Reliance's O2C business has always been a major source of revenue. But this time, a decline was recorded in this as well. According to Motilal Oswal, O2C's consolidated EBITDA decreased by 4 percent quarter-on-quarter and was 8 percent lower than their estimate. The main reasons for this were plant shutdowns and a reduction in volume. Nuwama said that the O2C segment was affected by turnaround activities.

Jio Became the Company's Strength

In this quarter, Reliance Jio performed better than expected. According to Motilal Oswal, Jio's EBITDA increased by 5 percent and was 2 percent higher than estimated. The main reason for this was a reduction in operational costs and b margins. The EBITDA margin reached 97 percent. According to MK, Jio added 9.9 million new customers and ARPU increased to ₹208.8.

Mixed Reactions in Analysts' Opinions

Although Jio performed better, the weakness in the company's other segments was clearly visible in analysts' opinions. Macquarie reported that Jio remained b, but Retail was weak and there were signs of improvement in the O2C segment. Jefferies, JP Morgan, and Motilal Oswal have shown a positive outlook regarding Reliance's future, but have also expressed caution regarding the performance in the current quarter.

Lack of Confidence in the Market Became the Reason

It was assumed in the market that the company's profit, even though it was at a record level, mainly came from non-operational income, and not from the core business. Due to this, a lack of confidence was seen among investors and selling was seen in the shares. Investors were expecting that segments like O2C and Retail would perform bly, but this did not happen.

Brokerage Firms Gave New Targets

Jefferies has set a target price of ₹1,726 for Reliance, while JP Morgan has increased its old target of ₹1,568 to ₹1,695. This shows that there is optimism regarding the company in the long term, but caution is being exercised regarding performance in the short term.

Hope in Telecom from Increasing Customer Numbers

The increase in the number of customers and the improvement in ARPU in the telecom segment was a satisfying aspect for investors. But until Retail and O2C regain momentum, stability in the share seems difficult to expect. This was the reason why the market did not show confidence in the company despite the profit.