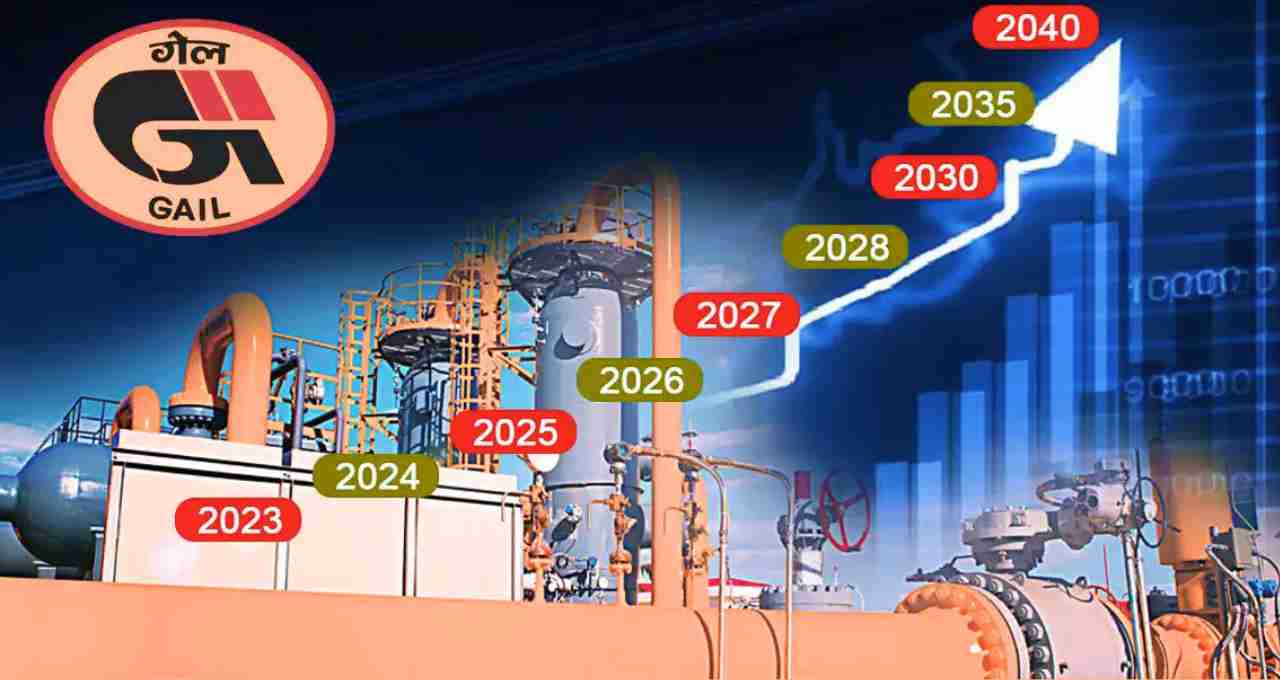

GAIL (India) Limited's earnings may see a sharp rise in the coming period due to a potential increase in gas transportation charges.

Government-owned Maharatna company GAIL India Limited has once again come onto investors' radar. This stock, which has been declining for the past six months, is now showing signs of regaining momentum. The reason is the potential increase in gas transmission tariff, i.e., transportation charges, and the strengthening of the company's business. According to a recent report by brokerage house ICICI Securities, GAIL's share price may climb up to 31 percent in the coming period.

Company's performance remained stable in FY25

GAIL has performed well in fiscal year 2024-25. Both the company's revenue and net profit have registered an increase of about 7 to 8 percent. Although the volume of gas transportation did not increase very rapidly, the company recorded an average of 127 million standard cubic meters per day (mmscmd) of gas transmission throughout the year. This figure was slightly better than last year.

Slight break in FY26, but confidence in long-term growth

The company has slightly reduced its forecasts for FY26. There are several reasons behind this. These include the non-completion of the Jagdishpur-Haldia-Bokaro-Dhamra Gas Pipeline (JHBDPL) project, the closure of a fertilizer factory in Kanpur, a decline in gas demand from power companies, and refineries opting for cheaper alternatives instead of gas.

Due to all these reasons, the company expects a slight slowdown in FY26, but the brokerage report says that growth may pick up again in FY27 and FY28. The expansion of the pipeline network across the country and the increasing demand for gas-based energy will be helpful in this.

Company preparing to increase gas transport tariff

GAIL may get approval to increase its gas transmission tariff by 15 to 20 percent in the next few months. This change will contribute significantly to its earnings. The current cost of gas is low, and there is not much increase in prices in the market. The company will directly benefit from this.

ICICI Securities believes that the increase in tariff will directly affect the company's margin and profit. It has also been said that the picture of the company's revenue growth may be much better in the next two years.

Company's expansion policy in the petrochemical sector

GAIL has recently acquired a petrochemical unit called JBF. This will increase its production capacity, and its involvement in the petrochemical business will also increase. Since the company has its own gas supply facility, it will not have to spend much on raw materials for production.

The decrease in the cost of gas, the increase in production capacity, and the recovery in market demand can make this business a major part of the company's earnings in the future.

Share valuation still considered cheap

GAIL's shares are still trading at attractive valuations. According to the brokerage report, the company's PE ratio is 9.9x while EV/EBITDA is around 7.4x. These figures show that the share is not overvalued yet and there is room for upside.

The company's share has declined by about 7 percent in the last 6 months. That is, investors can now get a chance to increase in it. The report says that considering the increase in tariffs and other positive factors, this share can reach a target of ₹245, which is 31 percent more than its current price of ₹187.

Market's eye on GAIL's strategy

GAIL's strategy is no longer limited to just the transportation business. The company is now working on several fronts such as petrochemicals, LNG terminals, pipeline expansion, and international collaboration. The government's prioritization of gas infrastructure and the availability of cheap domestic gas will also benefit the company.

Positive sentiment in the market

A positive trend is being seen in the market regarding GAIL. It has stabilized in the last four trading sessions, and now investors are waiting for the official announcement of the tariff increase. As soon as this announcement is made, a big jump can be seen in the share.

In the case of GAIL, it is clear that in the coming years, both the company's profits and earnings will see stable and b growth. Its expansion in the gas sector and its participation in the petrochemical business can make it more competitive than other government companies.