Approximately ₹350 crore had been invested in the company's German unit, which has now become insolvent, and its subsidiary. According to recent information, the closure of this unit will save the company from a monthly cash loss of approximately ₹9 crore.

Shares of Borosil Renewables Limited saw activity in the stock market on Monday morning. A major announcement from the company caught investors' attention. According to the information, GMB Glasmanufaktur Brandenburg GmbH, a subsidiary of Borosil Renewables located in Germany, has filed for bankruptcy in a German court. Following this development, the company's stocks saw a rise of up to 3 percent.

Production Plant Closed Since January

Production in this German unit had been completely shut down since January 2025. The reason cited was the decline in demand for solar glass in European markets. The company had previously indicated that local companies were under pressure due to the heavy dumping of cheap Chinese solar panels in Europe. GMB's situation was similar, as its operations began to incur losses due to declining demand and rising costs.

Risk of Losing ₹350 crore Investment

Borosil Renewables had invested about ₹350 crore in this German unit and its subsidiary company. Now that the company has entered bankruptcy proceedings, questions have been raised about this investment. However, the company also states that the closure of this unit will also stop the monthly cash loss of up to ₹9 crore. This loss had been a burden on the company's balance sheet for a long time.

Now, decisions related to the finances and operations of this unit will be taken under the supervision of an administrator. This means that GMB's expenses, liabilities, and cash flow will be handled through a person appointed by the court.

This Unit Contributed a Significant Portion to the Company's Earnings

GMB Glasmanufaktur Brandenburg GmbH's business played an important role in Borosil Renewables' total earnings. In the fiscal year 2025, the total income of this German unit was ₹327 crore, which was approximately 22 percent of the company's total income. However, this unit was not profitable and was continuously incurring losses.

This loss-making foreign unit consistently affected the company's profitability. According to the company management, this decision is expected to improve its financial position because it will no longer have to bear any losses from the loss-making unit.

Activity Seen in the Stock Market

On Monday, when this news came out, there was a sharp reaction in the market. In the initial hours, Borosil Renewables' shares saw a rise of about 3 percent. However, on Friday, the company's stocks closed at ₹495.55, down 0.9 percent. Looking at the whole year, this share has seen a decline of about 10 percent so far and is trading far below its 52-week high of ₹643.9.

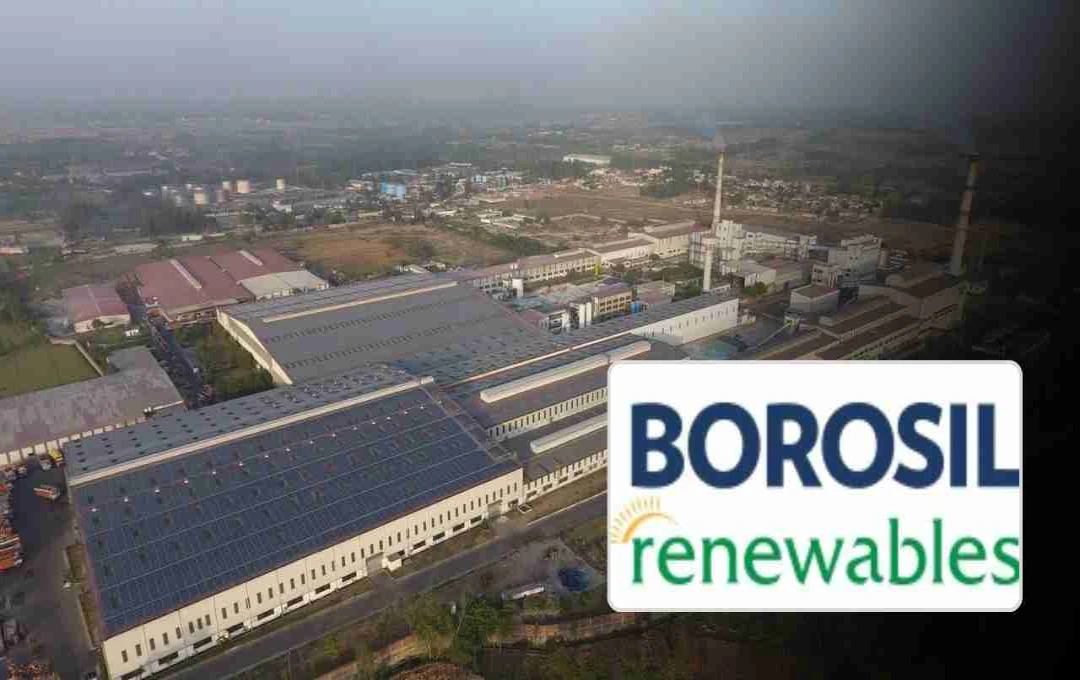

Focus Will Increase on Business in India

Borosil Renewables has now decided to focus entirely on the Indian market. The company believes that there are immense possibilities in the solar glass industry in India. Currently, the government's policies regarding solar energy in the country are also positive, and demand is increasing rapidly. In such a situation, the company is now working on a plan to invest its resources in the domestic market.

A statement issued by the company management said that this step is part of their long-term strategy. Its objective is to make better use of resources and further strengthen the company's position in the Indian market. Under this, preparations are being made to pay more attention to domestic production, distribution, and marketing in the coming time.

New Roadmap After Setback from Foreign Unit

After the commencement of GMB's bankruptcy proceedings, the change in the company's strategy is now clearly visible. Instead of foreign expansion, the company is now moving towards tapping domestic possibilities. Borosil Renewables is trying to regain its position due to the increasing demand for solar energy in India and the support being received from government schemes.

In this direction, the company's steps include increasing production capacity, controlling costs, and also focusing on the use of new technologies. The company wants to further strengthen its grip on the Indian solar glass market, where it already has a significant share.