RBI Reduces Repo Rate to 5.50%; PNB, Bank of India, and Karur Vysya Bank Cut Loan Interest Rates

Following the reduction in loan interest rates by PNB, Bank of India, and Karur Vysya Bank, home loan and other loan EMIs will decrease, providing financial relief to customers.

Bank Actions Following RBI Repo Rate Cut

Following the Reserve Bank of India's (RBI) 50 basis point reduction in the repo rate on June 6th, 2025, major banks have announced cuts to their loan interest rates. This will bring relief to borrowers of home loans, auto loans, and personal loans. Let's examine the new interest rates offered by these banks.

RBI Repo Rate Reduced by 50 Basis Points

On June 6th, 2025, the RBI reduced the repo rate to 5.50%, marking the third reduction this year. Previous cuts of 25 basis points each were implemented in February and April. This decision aims to boost economic growth and control inflation. Simultaneously, the RBI reduced the Cash Reserve Ratio (CRR) by 100 basis points to 3%, making an additional ₹2.5 lakh crore in liquidity available to banks.

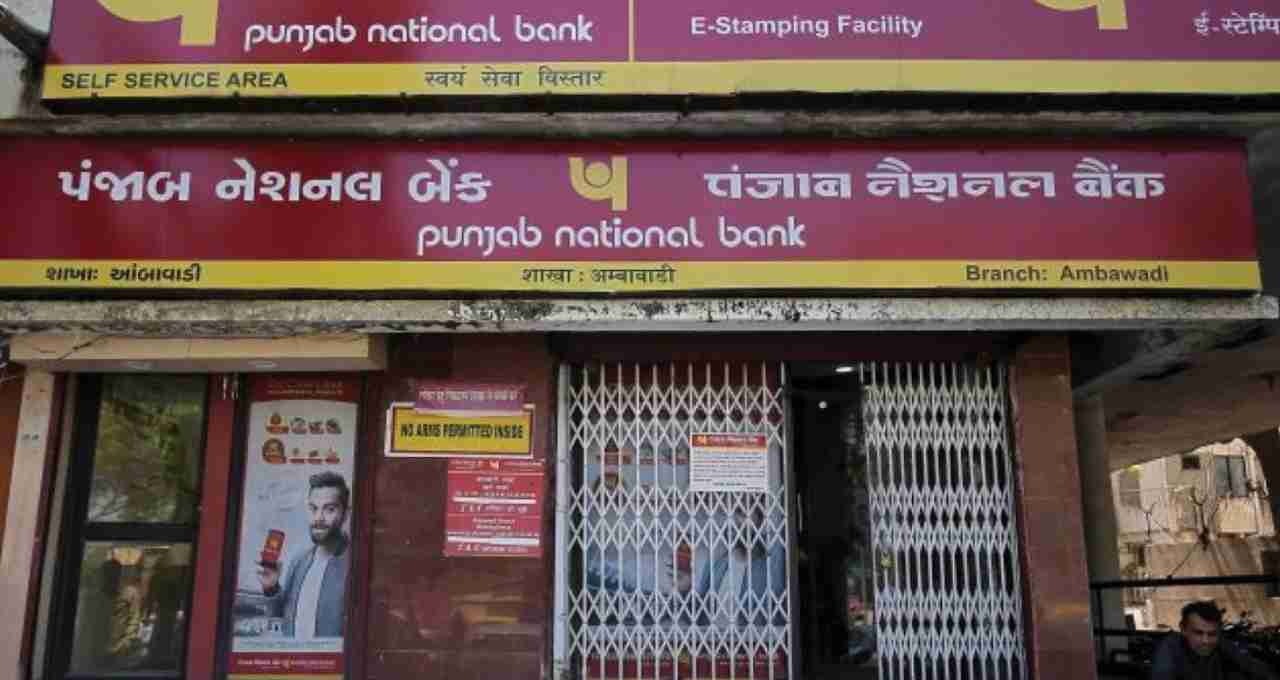

PNB's New Interest Rates

Following the RBI's repo rate cut, Punjab National Bank (PNB) reduced its Repo Linked Lending Rate (RLLR) from 8.85% to 8.35%. These new rates came into effect on June 9th, 2025. However, the bank did not alter its Marginal Cost of Funds Based Lending Rate (MCLR) or base rate.

Bank of India's New Interest Rates

Bank of India also reduced its Repo Based Lending Rate (RBLR) from 8.85% to 8.35% following the RBI's repo rate cut. These new rates became effective on June 6th, 2025, offering bank customers lower interest rates on loans.

Karur Vysya Bank's Interest Rate Reduction

Karur Vysya Bank announced a reduction in its Marginal Cost of Funds Based Lending Rate (MCLR). The 6-month MCLR was reduced from 9.9% to 9.8%, and the 12-month MCLR from 10% to 9.8%. This cut will provide bank customers with access to cheaper loans.

Bharatiya Bank's New Interest Rates

Following the RBI's repo rate cut, Bharatiya Bank reduced its Repo Linked Benchmark Lending Rates from 8.7% to 8.2%. These new rates became effective on June 9th, 2025, offering customers lower interest rates on loans.

Benefits for Loan Borrowers

These interest rate reductions will provide relief in EMIs for home loan, auto loan, and personal loan borrowers. For example, the EMI on a ₹50 lakh home loan over 20 years will decrease by approximately ₹1,569, resulting in annual savings of ₹18,828.