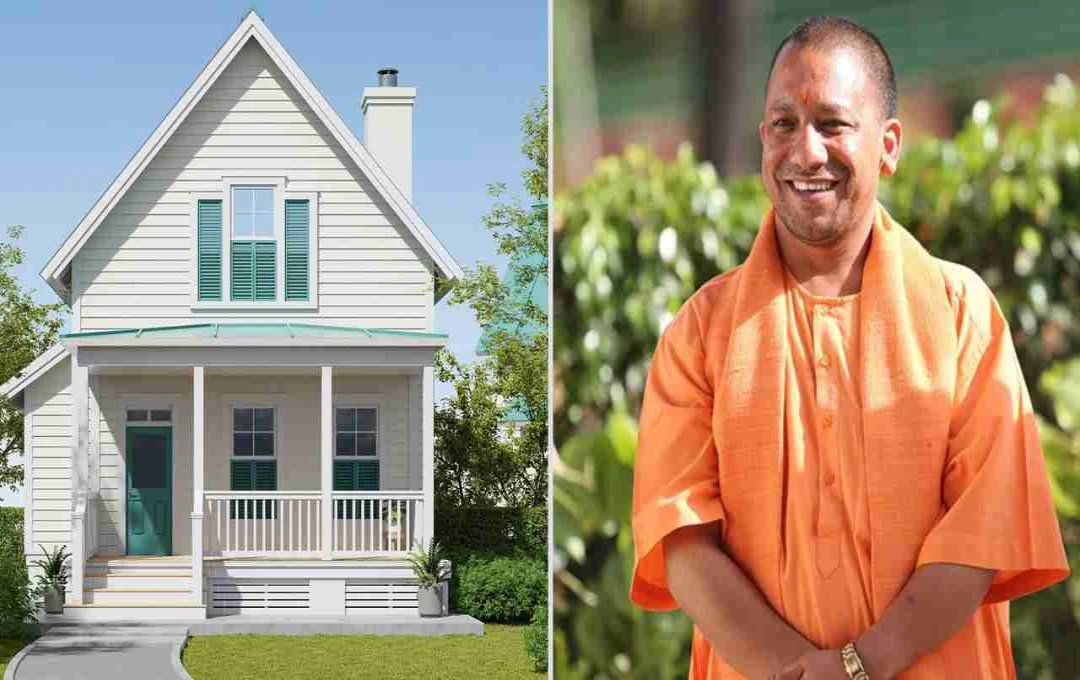

The Uttar Pradesh government has provided significant relief to its government employees. They can now avail home loans of up to ₹25 lakh at an interest rate of 7.5%. This facility will only be available to those who have completed at least five years of service. A loan of up to ₹10 lakh will also be available for house repairs.

Uttar Pradesh: In a move to provide relief to lakhs of government employees in the state, the government has increased the house loan limit from ₹7.5 lakh to ₹25 lakh. This decision has been taken keeping in mind the rising inflation and construction costs. Now, government employees will be able to avail a larger amount to build or buy their dream home, and that too at a subsidized interest rate.

Who is Eligible to Apply?

Under this new scheme issued by the Uttar Pradesh government, only those employees who have completed a minimum of 5 years of regular service will be eligible to benefit. This scheme will be applicable to all permanent employees and officers of the state government whose service record is satisfactory. This step will not only bring economic relief to the employees but will also strengthen their morale and stability.

What is the Loan Amount Available?

As per the government order, three criteria will be adopted to determine the loan amount, whichever is the lowest will be the final valid amount:

- Total sum of the employee's 34 months' basic salary.

- Maximum limit of ₹25 lakh.

- Actual purchase/construction cost of the house.

The amount which is the lowest among these three will be sanctioned as the loan.

What is the Interest Rate and Repayment Period?

The government will provide this loan at an interest rate of 7.5 percent, which is quite subsidized compared to the market rate. This loan can be repaid in a maximum period of 20 years. The aim is to ensure that employees do not have to bear an excessive burden of monthly installments and remain financially balanced.

The total cost of the building for which the loan is taken can be 139 times the employee's basic salary or a maximum of ₹1 crore. Also, an additional increase of up to 24 percent will be allowed in this value, allowing employees to buy a relatively larger and better house.

Facility Also Available for Repair and Expansion

The benefit of the new scheme will not only be limited to the construction or purchase of new buildings, but loan facility will also be provided for the repair and expansion of existing buildings. For this purpose, a maximum loan of ₹10 lakh will be available, which will have to be repaid with interest within 10 years.

If an employee already has a government housing loan outstanding, it will be mandatory for him to fully repay the old loan first, only then he will be able to apply for a new loan. In addition, after receiving the new loan, the employee will have to complete the registration, insurance, and other legal formalities of the building on time.

Why Was This Decision Taken?

According to the Finance Department, the old loan limit was very low considering the rising inflation and the rapid increase in the prices of land and construction materials. Due to this, employees faced difficulties in buying suitable houses. As a result, they were forced to take loans from private banks at high interest rates. This decision will reduce their financial burden and they will be able to realize their dream of owning a home at a reasonable rate.