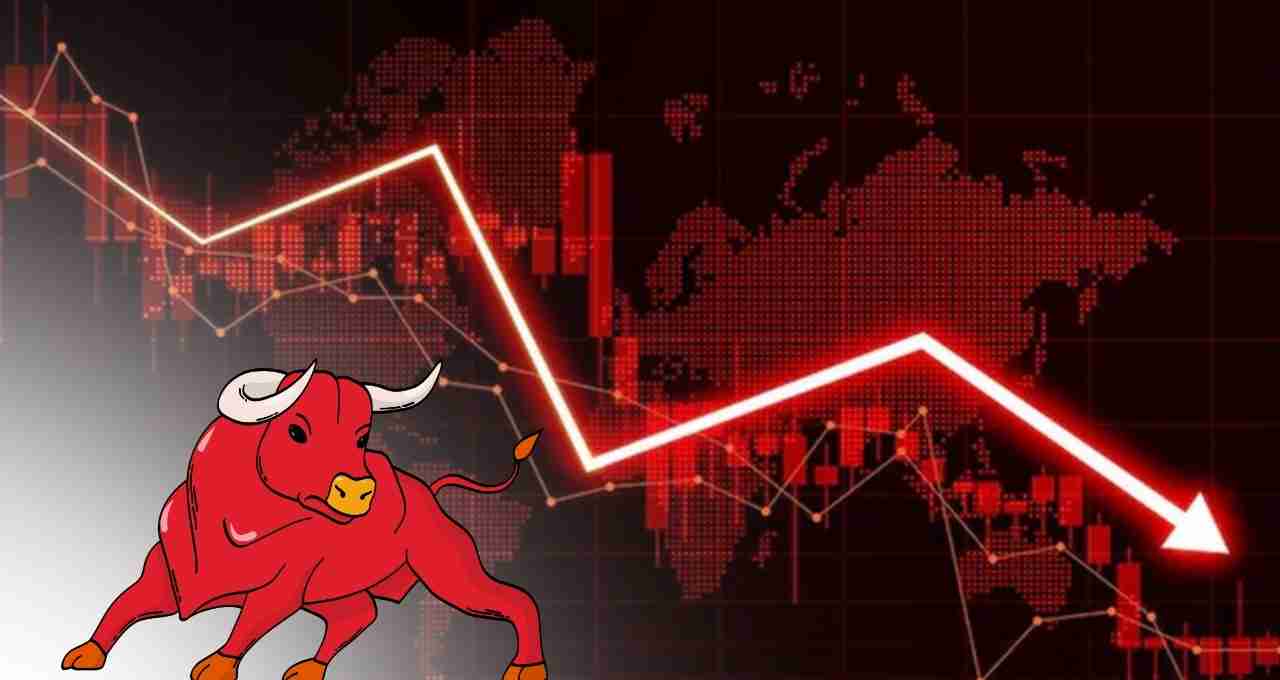

July 24, 2025, Thursday, was a tough day for the domestic stock market. Selling pressure was evident from the start of the fourth trading day of the week. The market faced heavy pressure due to continuous selling by foreign investors and weak global cues. In the morning session itself, the Sensex opened 130 points down at 82,595, and the Nifty slipped 23 points to 25,196.

Market Remained in Decline Throughout the Day

After a slight dip in the morning, investors hoped that the market would recover to some extent, but selling intensified after noon. The Sensex's decline increased to over 500 points, and it ultimately closed around the 82175 level. Meanwhile, the Nifty fell by nearly 150 points to close at 25,059.

Pressure on Midcap and Smallcap Stocks Too

Not only large-cap stocks, but also mid-cap and small-cap stocks witnessed heavy selling. Investors started withdrawing money from small and mid-sized stocks. As a result, the indices of both these segments closed in the red.

Mixed Performance on the Sectoral Front

Only select sectors managed to close in the green. Government banking and pharma indices closed with slight gains, but apart from that, IT, FMCG, Oil & Gas, Realty, and Energy stocks faced heavy pressure. The impact of continuous selling was seen in IT stocks.

Rupee Also Weakened Against the Dollar

Amid pressure from foreign cues, the rupee also weakened on Thursday. The rupee closed 16 paise lower at 85.63 against the dollar. This also affected market sentiment.

Top Losers: Stocks with the Biggest Declines

The Sensex companies that recorded the biggest declines in Thursday's trading included Tech Mahindra, TCS, Infosys, Kotak Mahindra Bank, Bajaj Finance, Trent, UltraTech Cement, and Axis Bank.

- Tech Mahindra shares saw the biggest fall as the impact of the global slowdown in the IT sector was evident.

- Shares of IT giants like TCS and Infosys also remained under pressure.

- Financial stocks like Kotak Mahindra Bank and Bajaj Finance also registered declines.

- Trent and UltraTech Cement, companies related to the consumer and infrastructure sectors, also faced heavy selling.

Top Gainers: Some Stocks Provided Relief

Despite the market decline, some select stocks showed strength. Prominent among these were Tata Motors, Sun Pharma, Tata Steel, and Eternal (formerly Zomato).

- Tata Motors shares saw strength as positive updates related to the company's electric vehicle division attracted investors.

- Sun Pharma and other pharma sector stocks saw buying, which led to the pharma index closing in the green.

- Tata Steel saw a slight gain, although metal stocks remained under pressure throughout the day.

- Eternal (formerly Zomato) shares saw gains, particularly due to investor interest in the quick commerce and food delivery segments.

Selling by Foreign Investors Increased Pressure

Foreign Portfolio Investors (FPIs) have been withdrawing money from the Indian market for the past few days. This trend remained unchanged on Thursday. Continuous selling by foreign funds weighed heavily on domestic stocks. Additionally, weak data related to economic activities in the US and China also weakened global investment sentiment.

Impact of Weekly Expiry

Thursday was the weekly expiry of the derivatives segment, which also led to increased volatility in the market. Traders cleared positions, which increased volatility and ultimately led to the market closing in the red.

Factors Contributing to the Negative Environment

- Selling by foreign investors

- Weakness in global cues

- Weakening rupee against the dollar

- Pressure from weekly expiry

- Selling in the IT and FMCG sectors