The Income Tax Department has clarified that the ITR Filing Deadline for the financial year 2024-25 (Assessment Year 2025-26) will not be extended beyond September 15, 2025. However, non-audit taxpayers will continue to have provisions for some relief even if they miss the deadline.

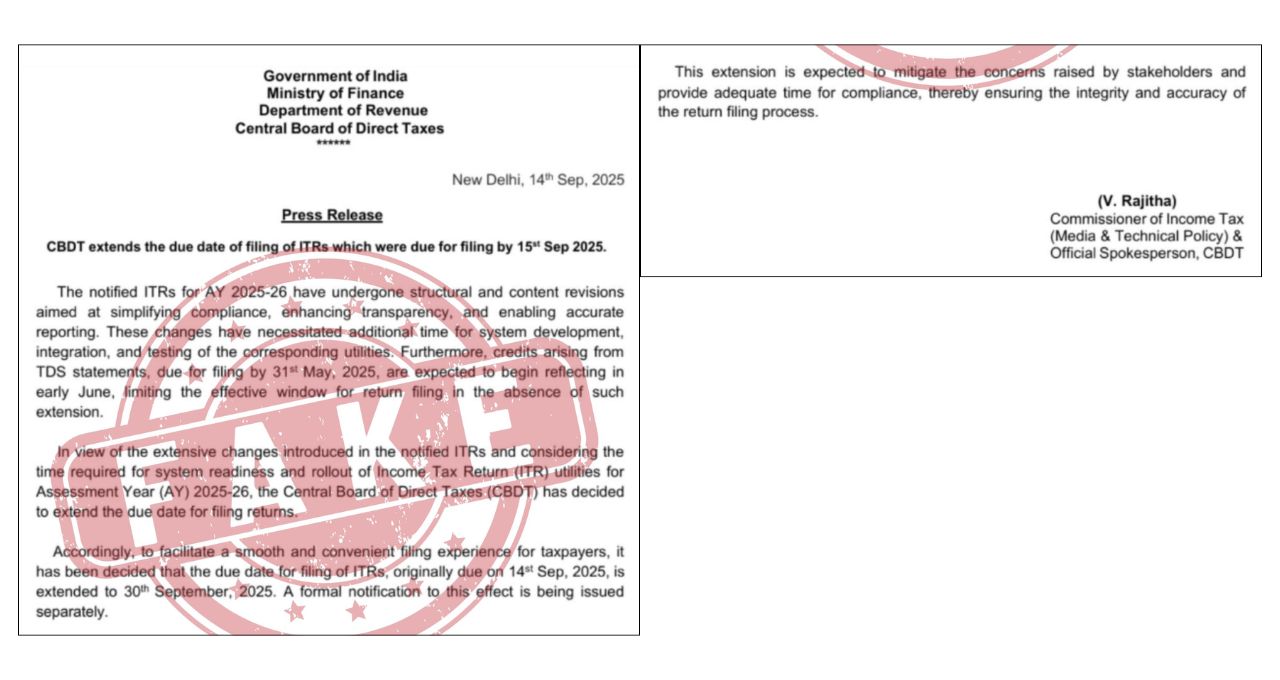

ITR Filing Deadline: The Income Tax Department confirmed on Monday that the last date for filing Income Tax Returns for the financial year 2024-25 (Assessment Year 2025-26) will remain September 15, 2025. The department stated that news about extending the deadline is fake and taxpayers should only rely on the official channels of the Income Tax Department.

Last Chance for Non-Audit Taxpayers

For the financial year 2024-25 (Assessment Year 2025-26), it is mandatory for non-audit taxpayers to file their Income Tax Returns by today, September 15, 2025. The Income Tax Department had previously extended the deadline from July 30 by an additional 45 days, but there is now no possibility of further extension.

If taxpayers miss the deadline, they may have to pay a penalty. However, the department has activated an option to provide them with relief in special circumstances. This facility can save them from unnecessary penalties.

Relief Still Available for Audit Taxpayers

Separate deadlines have been set for taxpayers whose accounts require auditing. Such taxpayers must submit their audit reports by September 30, 2025. The final date for filing ITR is set for October 31, 2025.

These include companies, proprietorships, and partnership firms. The Income Tax Department has not announced any changes to these dates so far, so taxpayers in the audit category must also prepare within the stipulated timelines.

Path to Amnesty for Delayed Filing

The biggest relief for non-audit taxpayers is that if they are unable to file their ITR today for any reason, the "Condonation of Delay" option is available on the e-filing portal. By using this facility, they can file their returns without paying a penalty.

This facility is applicable only in cases where the taxpayer can present a valid reason or evidence for being unable to file on time. For example, illness, accident, death in the family, or other emergencies. In such cases, the Income Tax Department may waive the penalty after examining the evidence.

Proof is Mandatory

To avail the benefit of the delay condonation facility, taxpayers will have to submit adequate documents. If the department finds the reason and evidence satisfactory, the taxpayer can file their ITR without a penalty by the end of the assessment year.

However, this facility is only for exceptional circumstances. Taxpayers who do not have concrete evidence will have to pay a penalty. Therefore, the department has clarified that filing ITR on time is the best and safest option.